EMA Accepts Regeneron/Sanofi's application for Dupixent

Regeneron Pharmaceuticals, Inc. REGN and partner Sanofi SNY announced that the European Medicines Agency (“EMA”) has accepted the companies’ application for review for Dupixent.

Both companies are seeking the agency’s approval for Dupixent use as an add-on maintenance treatment in certain adults and adolescents (12 years of age or older) with inadequately controlled moderate-to-severe asthma. The application is supported by data from three pivotal trials from the LIBERTY ASTHMA clinical development program.

We remind investors that Dupixent is already approved in the United States and the European Union for the treatment of adults with moderate-to-severe atopic dermatitis.

Meanwhile, the supplemental Biologics License Application for Dupixent as an add-on maintenance treatment in certain adults and adolescents (12 years of age or older) with moderate-to-severe asthma is also under review in the United States. The FDA has set a target action date of October 20, 2018.

Dupixent is being evaluated in a broad range of clinical development programs for diseases driven by type 2 inflammation, including pediatric atopic dermatitis (phase III), nasal polyps (phase III) and eosinophilic esophagitis (phase II).

Per the development and commercialization collaboration agreement, Sanofi records product sales for Dupixent. Both Regeneron and Sanofi share profits and losses from sales of Dupixent. Regeneron has exercised its option to co-promote Dupixent in the United States but the company has not exercised any of it options to co-promote Dupixent outside the United States.

Sales of Dupixent came in at $256.5 million in 2017. A potential label expansion of the drug will further boost sales.

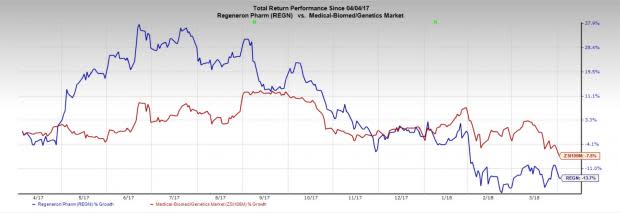

Regeneron’s shares have lost 13.7% in the past year compared with the industry’s decline of 7.5%.

We are encouraged by Regeneron’s strategy of signing deals to boost its portfolio and pipeline. Last month Regeneron entered into a collaboration agreement with Alnylam Pharmaceuticals ALNY for identification of RNAi therapeutics for nonalcoholic steatohepatitis, chronic liver disease, and other related diseases.

Regeneron’s key growth driver, Eylea, continues to drive revenues.

Zacks Rank & Another Key Pick

Regeneron currently sports a Zacks Rank #1 (Strong Buy).

Another top-ranked stock in the health care sector is Ligand Pharmaceuticals LGND, with a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ligand’s earnings per share estimates increased 11% to $4.20 for 2018 and 12% to $5.32 for 2019 over the last 30 days. The company delivered a positive earnings surprise in three of the four trailing quarters with an average beat of 24.88%. The company’s shares have returned 23% so far this year.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Alnylam Pharmaceuticals, Inc. (ALNY) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research