EMCOR's (EME) Q2 Earnings & Revenues Beat Estimates, View Up

EMCOR Group Inc. EME reported better-than-expected results in second-quarter 2019. Both the top and bottom lines not only surpassed the respective Zacks Consensus Estimate but also increased year over year. The solid performance was mainly driven by 15.2% organic growth and double-digit revenue improvement in each of its domestic segments.

Notably, the company raised its full-year 2019 guidance for revenues and earnings.

The company reported adjusted earnings of $1.49 per share, beating the consensus mark of $1.30 by 14.6%. Also, the reported figure increased 23.1% from the year-ago quarter. The improvement was driven by strong revenue growth across the board and disciplined project execution.

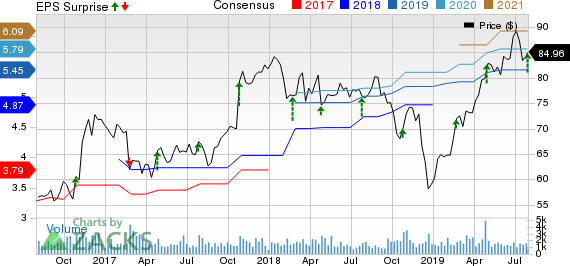

EMCOR Group, Inc. Price, Consensus and EPS Surprise

EMCOR Group, Inc. price-consensus-eps-surprise-chart | EMCOR Group, Inc. Quote

Revenues during the quarter came in at $2.32 billion, which surpassed the consensus mark of $2.09 billion by 19% and grew 19% year over year. The company experienced solid demand across geographies and end-markets served.

Segment Details

The U.S. Construction segment generated revenue and operating income growth of 15.7% and 4.7% year over year, respectively.

The U.S. Electrical Construction segment’s revenues increased 13.7% year over year. Notably, the reported growth was organic. The U.S. Mechanical Construction segment reported revenue growth of 9.4%, organically, from a year ago. Markedly, acquisitions added 18.7% to the said growth.

Revenues in the U.S. Building Services segment maintained robust momentum on double-digit revenue growth and operating income. The solid improvement was driven by strong demand in mechanical and energy services businesses, and continued execution of several large contracts within the commercial site-based business.

The U.S. Industrial Services unit posted an impressive revenue growth of 60.6% year over year, given field services operations. The U.K. Building Services segment registered 6.7% year-over-year revenue improvement and 19% operating income growth, backed by strong demand.

Operating Highlights

Selling, general and administrative expenses — as a percentage of revenues — were 9.7%, in line with the prior-year period.

Non-GAAP operating income (excluding impairment loss on identifiable intangible assets) totaled $120 million during the quarter, higher than $100.6 million in the prior-year period. Adjusted operating margin was 5.2%, up 10 basis points (bps) from the prior-year figure of 5.1%. The upside was mainly driven by exceptional execution of cost-control measures.

Liquidity & Cash Flow

As of Jun 30, 2019, the company had cash and cash equivalents of $213.4 million compared with $363.9 million at 2018-end. Long-term debt and finance lease obligations totaled $251.4 million, down from $254.8 million recorded on Dec 31, 2018.

In the first six months of 2019, EMCOR used $42.2 million cash in operating activities compared with $32.7 million in the comparable prior-year period.

2019 Guidance Raised

Buoyed by solid first-half performance, favorable project mix and the assumption of continuation of current market conditions, EMCOR lifted its view for full-year 2019 earnings as well as revenues.

EMCOR projects revenues between $8.8 billion and $8.9 billion, up from the prior guided range of $8.5-$8.6 billion for the year. The company now expects earnings within $5.50-$5.75 a share, up from the prior expectation of 5.00-$5.50.

Zacks Rank

EMCOR, which share space with MasTec, Inc. MTZ, Dycom Industries, Inc. DY and Great Lakes Dredge & Dock Corporation GLDD in the Zacks Building Products - Heavy Construction industry, currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

Great Lakes Dredge & Dock Corporation (GLDD) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

MasTec, Inc. (MTZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research