Emerson's (EMR) Q4 Earnings and Revenues Miss Estimates

Emerson Electric Co. EMR reported weaker-than-expected results for fourth-quarter fiscal 2018 (ended September 2018).

Earnings/Revenues

Adjusted earnings came in at 89 cents per share, higher than the year-ago figure of 83 cents. Favorable global market conditions and strong top-line growth boosted the bottom line, which was offset by high cost of sales and interest expenses. However, the bottom line missed the Zacks Consensus Estimate of 92 cents.

For fiscal 2018, the company’s adjusted earnings came in at $3.38.

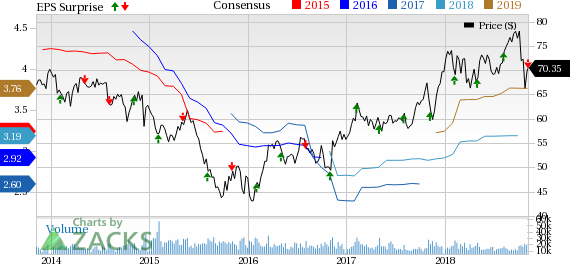

Emerson Electric Co. Price, Consensus and EPS Surprise

Emerson Electric Co. Price, Consensus and EPS Surprise | Emerson Electric Co. Quote

Revenues in the reported quarter were $4,888 million, up from the year-ago figure of $4,435 million. This upside stemmed from strong demand from mature and emerging markets as well as acquisition benefits, partially offset by negative foreign currency-translation impact. However, the top line missed the Zacks Consensus Estimate of $4,940 million.

For fiscal 2018, net sales came in at $17.4 billion, up 13.7% year over year, indicating strengthening industrial and emerging market demand.

Segmental Break-Up

Quarterly sales of Automation Solutions segment were $3,228 million, up 11.5% year over year. Underlying sales also grew 9% as favorable trends in key served markets supported operations. Underlying sales in North America rose 11% led by continued favorable trends across most key markets. Asia underlying sales were up 11%, while Europe was up 2%. Latin America and Middle East/Africa were up 12% and 7%, respectively.

The Commercial & Residential Solutions platform witnessed a 7% increase in net sales and 5% growth in underlying sales, with net sales coming in at $1,655 million. The top line was supported by robust demand in North American commercial and residential air conditioning markets along with solid demand in global professional tools and cold chain markets. North America was up an impressive 8% on account of robust demand across all key end markets. Asia witnessed growth of 3% year over year, while Europe was up 4%. Latin America recorded an increase of 5%, while the Middle East/Africa was down 16%.

Under the platform, the Climate Technologies business grew 5.4% year over year to $1,168 million, while the Tools & Home Products unit jumped 12% to $487 million.

Costs/Margins

Cost of sales in the reported quarter was $2,823 million, up 7.3% year over year. Gross profit margin expanded 150 basis points (bps) to 42.2%. The upside stemmed from stronger revenues and benefits of the restructuring actions undertaken.

Selling, general and administrative expenses in the reported quarter were $1,180 million, up from $997 million reported a year ago. Adjusted earnings before interest and taxes margin was 16%, down 30 bps year over year.

Liquidity & Cash Flow

Exiting the fiscal year, the company had cash and cash equivalents of $1,093 million, with long-term debt of $3,137 million. Net cash provided by operating activities in fiscal 2018 grew 51.3% from the prior fiscal year to $2,892 million.

Outlook

For fiscal 2019, Emerson expects net sales for the year to increase 6-9%, with underlying sales to be up 4-7%.

The company projects GAAP earnings per share for fiscal 2019 to be in the range of $3.55-$3.70.

Emerson projects Automation Solutions net sales to be up 5-8%, while Commercial & Residential Solutions net sales is anticipated to jump 3-5%.

Zacks Rank & Stocks to Consider

Emerson currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same space are Enersys ENS, Rexnord Corporation RXN and IDEX Corporation IEX. While Enersys sports a Zacks Rank #1 (Strong Buy), Rexnord and IDEX carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Enersys surpassed estimates thrice in the trailing four quarters, the average beat being 2.86%.

Rexnord exceeded estimates in each of the trailing four quarters, the average beat being 17.71%.

IDEX surpassed estimates in each of the trailing four quarters, the average beat being 5.80%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Rexnord Corporation (RXN) : Free Stock Analysis Report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

Enersys (ENS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research