Emerson's (EMR) Fluxa Buyout Aids Software & Solutions Suite

Emerson Electric Co. EMR recently announced that it has completed the acquisition of Fluxa. The financial terms of the transaction were kept under wraps.

Shares of Emerson declined 1.2% yesterday, ending the trading session at $79.5.

Based in Glendale, CA, Fluxa is a pioneer in the life sciences industry, which uses state-of-the-art technology to reduce the time-to-market for new drugs and therapies by collaborating with the drug manufacturing companies. The acquired entity was founded in 2017.

Inside the Headlines

The technology and software provided by Fluxa speeds up the availability of latest drugs, vaccines and therapies for critical illness. The buyout will enable Emerson to leverage Fluxa’s PKM software coupled with its DeltaV control system and life sciences automation software to provide customers with a comprehensive line of solutions for developing new drugs.

The addition of Fluxa complements Emerson’s software and solutions portfolio. This acquisition will help the latter deliver lifesaving therapy and medicines to patients in less time. It’s worth mentioning that Emerson also invested in Fluxa’s equity in 2021.

Zacks Rank, Price Performance and Estimate Trend

Emerson, with a $47.2-billion market capitalization, currently carries a Zacks Rank #3 (Hold). EMR stands to benefit from strength across its end markets and a robust backlog level in the quarters ahead. However, woes related to supply chain, labor and logistics might weigh on it in the near term.

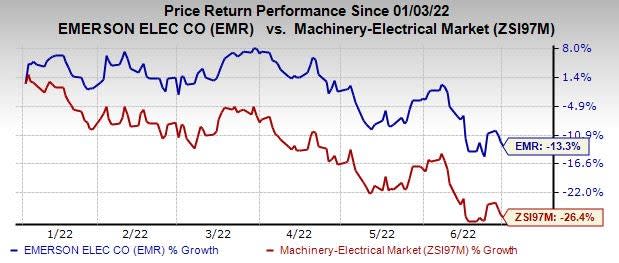

Image Source: Zacks Investment Research

In the past six months, the stock has lost 13.3% compared with the industry’s decline of 26.4%.

In the past 60 days, the Zacks Consensus Estimate for EMR’s earnings has moved up 1.6% to $5.06 for fiscal 2022 (ending September 2022), while the same for fiscal 2023 (ending September 2023) has been raised 0.9% to $5.42.

Stocks to Consider

Some better-ranked stocks in the Industrial Products sector are Greif Inc. GEF, Myers Industries MYE and Titan International TWI, each flaunting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here

Greif has an estimated earnings growth rate of 36% for the current year. In the past 60 days, the Zacks Consensus Estimate for current-year earnings has been revised 17% upward.

Greif pulled off a trailing four-quarter earnings surprise of 22.9%, on average. GEF’s shares have gained 4.4% in the past six months.

Myers Industries has an expected earnings growth rate of 67% for 2022. The Zacks Consensus Estimate for the current year’s earnings has moved up 15% in the past 60 days.

MYE has a trailing four-quarter earnings surprise of 20.1%, on average. Myers Industries’ shares have increased 15.2% over the past six months.

Titan International has an estimated earnings growth rate of 165% for the current year. In the past 60 days, the Zacks Consensus Estimate for current-year earnings has been revised 55% upward.

Titan International pulled off a trailing four-quarter earnings surprise of 56.4%, on average. The stock has surged 37% in six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

Titan International, Inc. (TWI) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

Myers Industries, Inc. (MYE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research