Is Enable Midstream Partners LP (ENBL) Going to Burn These Hedge Funds?

A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended June 28, so let’s proceed with the discussion of the hedge fund sentiment on Enable Midstream Partners LP (NYSE:ENBL).

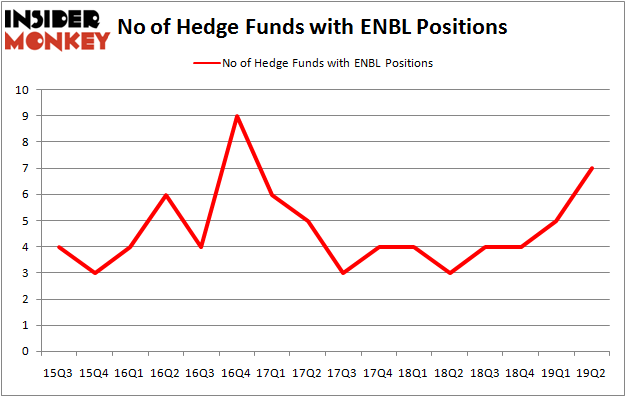

Is Enable Midstream Partners LP (NYSE:ENBL) a buy, sell, or hold? The smart money is getting more bullish. The number of long hedge fund bets advanced by 2 lately. Our calculations also showed that ENBL isn't among the 30 most popular stocks among hedge funds.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most shareholders, hedge funds are assumed to be unimportant, old investment tools of the past. While there are greater than 8000 funds in operation at the moment, Our experts hone in on the moguls of this club, around 750 funds. It is estimated that this group of investors preside over the lion's share of the smart money's total asset base, and by shadowing their unrivaled picks, Insider Monkey has formulated several investment strategies that have historically outrun the market. Insider Monkey's flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points per annum since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn't rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We're going to take a glance at the key hedge fund action encompassing Enable Midstream Partners LP (NYSE:ENBL).

What have hedge funds been doing with Enable Midstream Partners LP (NYSE:ENBL)?

At the end of the second quarter, a total of 7 of the hedge funds tracked by Insider Monkey were long this stock, a change of 40% from one quarter earlier. On the other hand, there were a total of 3 hedge funds with a bullish position in ENBL a year ago. With hedgies' sentiment swirling, there exists a select group of noteworthy hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

More specifically, Zimmer Partners was the largest shareholder of Enable Midstream Partners LP (NYSE:ENBL), with a stake worth $16.9 million reported as of the end of March. Trailing Zimmer Partners was Perella Weinberg Partners, which amassed a stake valued at $11.4 million. Arrowstreet Capital, Segantii Capital, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, key hedge funds were leading the bulls' herd. Perella Weinberg Partners, created the most valuable position in Enable Midstream Partners LP (NYSE:ENBL). Perella Weinberg Partners had $11.4 million invested in the company at the end of the quarter. Matthew Hulsizer's PEAK6 Capital Management also initiated a $0.5 million position during the quarter.

Let's check out hedge fund activity in other stocks - not necessarily in the same industry as Enable Midstream Partners LP (NYSE:ENBL) but similarly valued. We will take a look at Texas Pacific Land Trust (NYSE:TPL), KT Corporation (NYSE:KT), Adaptive Biotechnologies Corporation (NASDAQ:ADPT), and Algonquin Power & Utilities Corp. (NYSE:AQN). This group of stocks' market caps are similar to ENBL's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position TPL,16,1515971,5 KT,19,320612,0 ADPT,38,3181443,38 AQN,9,63964,-3 Average,20.5,1270498,10 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.5 hedge funds with bullish positions and the average amount invested in these stocks was $1270 million. That figure was $40 million in ENBL's case. Adaptive Biotechnologies Corporation (NASDAQ:ADPT) is the most popular stock in this table. On the other hand Algonquin Power & Utilities Corp. (NYSE:AQN) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Enable Midstream Partners LP (NYSE:ENBL) is even less popular than AQN. Hedge funds dodged a bullet by taking a bearish stance towards ENBL. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately ENBL wasn't nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); ENBL investors were disappointed as the stock returned -9.9% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

Florida Millionaire Predicts 'Cash Panic' In 2019