Enbridge (ENB) Rises Marginally as Q1 Earnings Top Estimates

Enbridge Inc. ENB stock has rallied a marginal 0.1% since it reported better-than-expected earnings for first-quarter 2021 on May 7.

The energy major reported first-quarter 2021 adjusted earnings per share of 62 cents, beating the Zacks Consensus Estimate of 56 cents. The bottom line was flat with the year-ago figure.

Total revenues increased 4.4% year over year to $9,352 million.

The better-than-expected quarterly earnings were driven by higher gas distribution charges and contributions from renewable power generation.

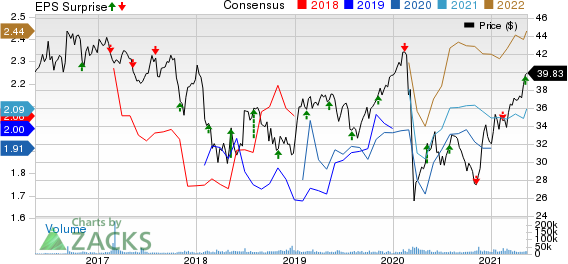

Enbridge Inc Price, Consensus and EPS Surprise

Enbridge Inc price-consensus-eps-surprise-chart | Enbridge Inc Quote

Segment Analysis

Enbridge conducts business through five segments — Liquids Pipelines, Gas Transmission and Midstream, Gas Distribution and Storage, Renewable Power Generation, and Energy Services.

Liquids Pipelines: The segment’s adjusted earnings before interest, income taxes, and depreciation and amortization (EBITDA) totaled C$1,881 million, down from C$1,919 million in the year-earlier quarter. Lower contributions from Gulf Coast and Mid-Continent System hurt the segment, partially offset by higher contributions from Mainline System.

Gas Transmission and Midstream: The segment’s adjusted earnings totaled C$1,007 million, down from C$1,097 million in first-quarter 2020. Lower contributions from the US Gas Transmission business affected the segment’s performance.

Gas Distribution and Storage: The unit generated a profit of C$646 million compared with C$609 million in the prior-year quarter, thanks to higher distribution charges.

Renewable Power Generation: The segment recorded earnings of C$154 million, up from C$118 million in the prior-year quarter as some of the offshore facilities witnessed strong wind production.

Energy Services: The segment incurred a loss of C$75 million wider than the loss of C$13 million in first-quarter 2020.

Distributable Cash Flow (DCF)

For first-quarter 2021, the company reported DCF of C$2,761 million, representing an increase from C$2,706 million a year ago.

Balance Sheet

At the end of first-quarter 2021, the company reported long-term debt of C$62,688 million, and cash and cash equivalents of C$465 million. The current portion of long-term debt was C$4,014 million. Its debt to capitalization was 51.8% at first quarter-end.

Guidance

For 2021, the company reaffirmed its guidance for DCF per share at the band of C$4.70-C$5.00. It continues to project 2021 EBITDA within C$13.9-C$14.3 million.

Zacks Rank & Stocks to Consider

Enbridge currently carries a Zacks Rank #3 (Hold). Meanwhile, a few better-ranked players in the energy space include Whiting Petroleum Corporation WLL, Continental Resources, Inc. CLR and Matador Resources Company MTDR. All the stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Whiting Petroleum has witnessed upward earnings estimate revisions for 2021 in the past 30 days.

Continental is expected to witness earnings growth of 256% in 2021.

Matador is likely to see earnings growth of 300% in 2021.

Zacks' Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create ""the world's first trillionaires."" Zacks' urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Enbridge Inc (ENB) : Free Stock Analysis Report

Continental Resources, Inc. (CLR) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

Whiting Petroleum Corporation (WLL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research