Enbridge Energy (EEP) Q1 Earnings Beat, Revenues Fall Y/Y

Enbridge Energy Partners L.P. EEP reported first-quarter 2018 adjusted earnings of 25 cents per unit, which surpassed the Zacks Consensus Estimate of 20 cents. The bottom line improved from the year-earlier quarter’s level of 16 cents. The uptick was mainly driven by higher deliveries on the Lakehead pipeline system, North Dakota system and Mid Continent system.

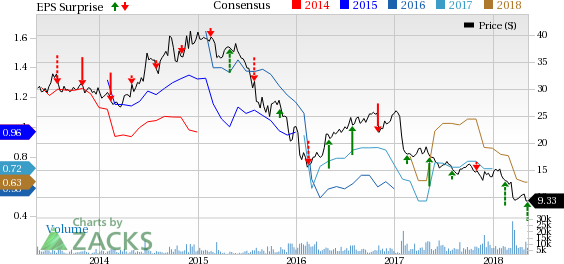

Enbridge Energy Partners, L.P. Price, Consensus and EPS Surprise

Enbridge Energy Partners, L.P. Price, Consensus and EPS Surprise | Enbridge Energy Partners, L.P. Quote

Total revenues in the quarter declined to $592 million from the year-ago quarter’s tally of $1,178.7 million. The downside was led by loss in the Other segment.

FERC’s decision restricts entities organized as MLPs from recovering an income tax allowance in their cost of service rates impacted the partnership’s distributable cash flow by $125 million.

Distribution

Enbridge Energy announced a quarterly cash distribution to 35 cents per unit or $1.40 on an annualized basis. The distribution will be paid on May 15, to unitholders on record at the close of business as of May 8.

Segment Performance

The partnership manages its business under one head — Liquids. All other businesses are reported under the head — Other.

Liquids: Adjusted operating income in the Liquids segment increased to $432 million from $396 million in the first quarter of 2017. The upside was driven by higher average rates and strong transportation volumes in the Lakehead pipeline system, North Dakota system and Mid Continent system.

Other: The unit reported operating loss of $2 million against an operating income of $18 million in the year-ago quarter.

Q1 Price Performance

In the first quarter, Enbridge Energy’s shares lost 30.2% compared with the industry’s 14.3% decline.

Zacks Rank & Key Picks

Enbridge Energy currently has a Zacks Rank #4 (Sell).

A few better-ranked players in the same sector are Nine Energy Service, Inc NINE, BP plc BP and CVR Refining, LP CVRR. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Nine Energy Service is engaged in delivering onshore completion and production services to unconventional oil and gas resource development. The company pulled off a positive earnings surprise of 6.25% in the preceding quarter.

BP is among the leading integrated energy players in the world. The company delivered an average positive earnings surprise of 29.6% in the trailing four quarters.

Sugar Land, TX-based CVR Refining is an independent downstream energy partnership with refining and associated logistics properties in the Midcontinent United States. The company delivered an average positive earnings surprise of 7.05% in the last four quarters.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CVR Refining, LP (CVRR) : Free Stock Analysis Report

Enbridge Energy Partners, L.P. (EEP) : Free Stock Analysis Report

BP p.l.c. (BP) : Free Stock Analysis Report

Nine Energy Service, Inc. (NINE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research