End-Market Strength Aids EnerSys (ENS) Amid Supply-Chain Woes

EnerSys ENS specializes in manufacturing and selling industrial batteries. It also provides power equipment, battery charges and related accessories. Solid fundaments and strength in segmental businesses are benefiting the company, while supply-chain issues and cost inflation are affecting it.

The Pennsylvania-based company presently carries a Zacks Rank #3 (Hold). The stock belongs to the Zacks Manufacturing - Electronics industry, which comes under the ambit of the Zacks Industrial Products sector. The industry is in the top 41% (with a rank of 105) of more than 250 Zacks industries.

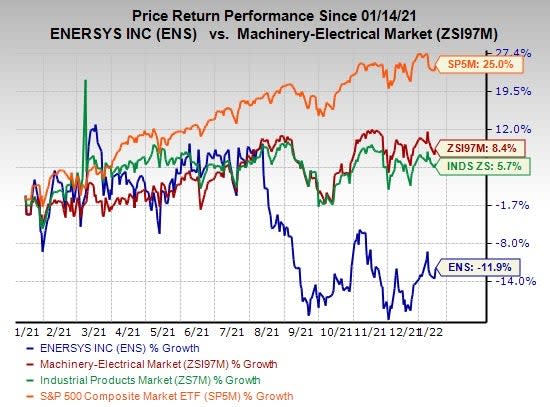

In the past year, the company’s shares have lost 11.9% against the industry’s growth of 8.4%. Also, the S&P 500 and the sector have gained 25% and 5.7%, respectively, during the same period.

Image Source: Zacks Investment Research

Factors Influencing EnerSys

EnerSys’ presence in multiple end markets, including energy, industrial, electric utilities, mining, and transportation, helps lower risks arising from too much dependence on a single or few markets. In the quarters ahead, strength across lithium-based battery technology, transportation, and defense end markets are anticipated to be beneficial. Also, geographically, the company seems well-placed in the Americas, Asia, and the Middle East and Africa (EMEA) regions.

The company’s solid product offerings, which include NexSys Thin Plate Pure Lead (TPPL) products, and focus on product innovation as well as sound shareholder-friendly policies raise its attractiveness. Notably, EnerSys had a backlog of >$1 billion at the end of second-quarter fiscal 2022 (ended Oct 3, 2021). The company’s segments, Energy Systems and Motive Power, are performing well. Revenues for Energy Systems grew 8.5% year over year in the fiscal second quarter and that of Motive Power increased 21.6%.

On the slip side, EnerSys is facing costs and margin-related headwinds. In the fiscal second quarter, it recorded a 15.6% increase in the cost of sales and a 5.3% expansion in operating expenses. Its gross margin, however, fell 260 basis points (bps) year over year and the operating margin was down 160 bps. In the quarters ahead, the company might continue to suffer from labor, and high tariff and freight problems. Shortages of components might be worrying as well.

EnerSys is exposed to risks from a highly leveraged balance sheet and international operations. High capital expenditure can also put pressure. For fiscal 2022 (ending March 2022), the company anticipates a capital expenditure of $100 million.

For the third quarter of fiscal 2022 (ended December 2021, results are awaited), EnerSys anticipates earnings between 96 cents and $1.06 per share. Earnings were $1.27 per share in the year-ago quarter and $1.01 per share in the previous quarter.

The Zacks Consensus Estimate for EnerSys’ earnings per share is pegged at $4.46 for fiscal 2022 and $5.29 for fiscal 2023 (ending March 2023), suggesting a year-over-year decline of 0.7% and growth of 18.6%, respectively. Then again, estimates for both fiscal years have been unchanged in the past 60 days.

Enersys Price and Consensus

Enersys price-consensus-chart | Enersys Quote

Stocks to Consider

Three better-ranked stocks from the industry are mentioned below.

Regal Rexnord Corporation RRX presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The company’s earnings surprise in the last reported quarter was 0.85%. The same for the last four quarters was 10.96%, on average.

In the past 60 days, the Zacks Consensus Estimate for Regal Rexnord’s earnings has increased 0.2% for 2022. RRX’s shares have rallied 18.3% in the past three months.

Franklin Electric Co., Inc. FELE reported better-than-expected results in the last reported quarter, with earnings surpassing estimates by 6.52%. Its earnings surprise in the last four quarters was 16.27%, on average. The company presently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Franklin Electric’s earnings has increased 0.6% for 2022 in the past 60 days. FELE’s shares have rallied 8.7% in the past three months.

Zurn Water Solutions Corporation’s ZWS results in the last reported quarter were impressive, with an earnings beat of 111.54%. Its last four quarters’ average earnings surprise was 33.09%. The company presently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Zurn Water’s earnings has increased 2.8% for 2022 in the past 60 days. ZWS’s shares have lost 6.5% in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Franklin Electric Co., Inc. (FELE) : Free Stock Analysis Report

Enersys (ENS) : Free Stock Analysis Report

Regal Rexnord Corporation (RRX) : Free Stock Analysis Report

Zurn Water Solutions Corporation (ZWS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research