This Energy Drink Stock Could See Big January Returns

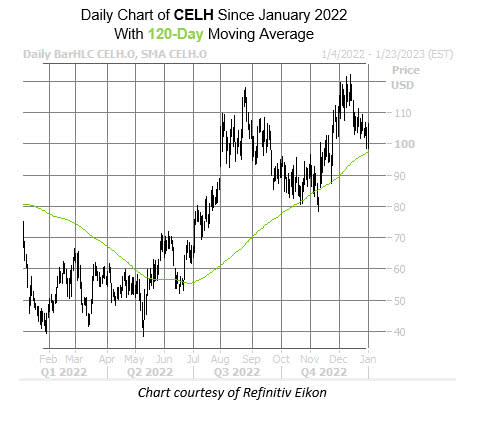

While much of the market is coming off a dismal year, one stock in particular was able to buck that trend: Celsius Holdings, Inc. (NASDAQ:CELH). In fact, the security added nearly 40% in 2022 and managed to nab multiple record highs throughout the year. The equity is cooling from its latest peak of $122.24, touched in mid-December, though there's evidence that there could be even more impressive trading to come in 2023.

This is because CELH just pulled back to its 120-day moving average on the charts. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, the energy drink stock tends to realize impressive returns after these pullbacks. This data shows six similar signals in the past three years. One month after 83% of these signals, CELH was positive, averaging an impressive 22.7% return. A similar move from its current perch would put the equity right back below its December high at $121.17.

It's also worth noting that CELH is right on the cusp of "oversold" territory, which could mean a short-term bounce is on its way. This is because the stock sports a 14-day Relative Strength Index (RSI) of 32.

An unwinding of pessimism among options traders could provide additional tailwinds. The equity sports a Schaeffer's put/call open interest ratio (SOIR) of 1.15, which stands above 95% of readings from the past year. In other words, short-term options players have rarely been more put-biased.