Engaged Capital Sends Letter to Board of Quotient Technology Inc.

Share Price Performance Since IPO

Share Price Performance Since IPO

TSR

TSR

Quarterly EBITDA Guidance vs. Consensus

Quarterly EBITDA Guidance vs. Consensus

Annual EBITDA Guidance Throughout The Year

Annual EBITDA Guidance Throughout The Year

FY21E EBITDA Q4'21E EBITDA

$ in millions

QUOT Financial Performance

QUOT Financial Performance

Believes Quotient has highly valuable customer insights and technology solutions, but has consistently failed to deliver operational performance or stockholder returns since IPO in 2014

Criticizes Board for focusing on self-preservation rather than charting a value creating path forward for the Company

Maintains directors should be ashamed for manipulating director classes and implementing a 4.9% NOL pill

Calls for Board to finally work in the best interest of stockholders and act decisively to change the direction of the Company

NEWPORT BEACH, Calif., Nov. 17, 2021 (GLOBE NEWSWIRE) -- Engaged Capital, LLC, an investment firm specializing in enhancing the value of small and mid-cap North American equities and the owner of 6.5% of the outstanding shares of Quotient Technology Inc. (NYSE: QUOT) (the “Company”), today sent a letter to the Company’s Board of Directors.

The full text of the letter follows:

November 17, 2021

Quotient Technology Inc.

1260 East Stringham Avenue, Suite 600

Salt Lake City, Utah 84106

Attn: Board of Directors

Dear Board Members:

Engaged Capital, LLC (“Engaged,” “us,” or “we”) has been a significant stockholder in Quotient Technology Inc. (“QUOT” or the “Company”) since October 2020. Today, we own approximately 6.5% of the Company’s outstanding shares and are believed to be QUOT’s 3rd largest stockholder. Throughout the last two years, we have conducted deep research into QUOT and its relevant markets and have enjoyed an open dialogue with the Company’s leadership team. We believe the Company offers attractive solutions that deliver strong ROIs for its customers and has a significant opportunity to drive profitable growth due to its unique market position and industry tailwinds. While we have a significant ownership position because we believe QUOT is a very valuable asset, we have become increasingly concerned with the Company’s consistently poor performance, both in regards to the Company’s share price and operations. The most recent reported quarter, which saw the Company materially cut guidance and lose one of its largest and most important partners, has further increased our level of concern and sense of urgency to find a long-term solution that allows QUOT to maximize the value of its assets.

In addition to the Company’s operational struggles, we are alarmed by the Board of Directors’ (the “Board”) blatant disregard for good governance and dereliction of fiduciary duties to stockholders. Rather than taking decisive action to remedy the weak operating and share price underperformance, the Board has selfishly focused on employing strategies to further entrench itself. This has become glaringly obvious given the Board’s manipulation of director classes in July 2021 to reduce the number of directors up for election at the 2022 Annual Meeting, as well as the recently announced tax benefits preservation plan (the “NOL Pill”), which was clearly implemented to thwart stockholders like Engaged Capital from acquiring 4.9% or more of QUOT’s shares, notwithstanding the Board’s purported justification.

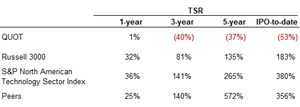

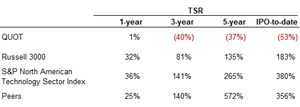

To put QUOT’s performance, or lack thereof, in perspective, since its IPO back in 2014, QUOT’s stock is down a whopping 53% and at today’s ~$7 share price, is trading close to all-time lows.1

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4d980eb6-1730-4459-ba75-8442c0c4425c

Compared to peers and broader market indices, over practically any relevant time frame, not only has QUOT’s stock declined, but peers have prospered. The relative underperformance is staggering, as over the past 5 years QUOT has underperformed peers by over 500%.2

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/83112d4f-0265-4c71-9872-a303a6de2ba1

The magnitude of relative value destruction is evidence that QUOT is suffering from a company-specific problem, not an industry- or market-wide issue. This disastrous performance raises serious questions as to why directors are focused on protecting themselves, rather than closely examining how to change the Company’s trajectory.

Unfortunately, what has proven to be consistent over the last several years is the Company’s ability to miss numbers and disappoint investors. Over the past four years, QUOT has provided quarterly guidance at or above consensus estimates only once and the Company has continually provided an outlook that is well below expectations, missing analysts’ quarterly targets by an average of ~35% over this period of time.3

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/7071070a-6c70-4ae6-9696-efa9c9145415

QUOT’s own forecasts have also proven to be completely unreliable and untrustworthy. The Company has reduced its own guidance almost every quarter over the past four years.4 As a result, management and the Board have lost all credibility with investors.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d4fb4f7f-c640-4d2c-8b3b-74189ae641fe

Coming into 2021, QUOT’s historic lack of credibility seemed to be understood by management and was targeted as a focus area to correct. A new approach was promised in February, when management provided its initial guidance for 2021. As Chairman and CEO Steven Boal described,

“the potential is there to outperform…. So, there is certainly an element of conservatism given our historical performance record…. yes, we’re taking a different approach. We’re trying to be as conservative and responsible as possible, so that we can deliver on what we say we’re going to do.”5

Then, in QUOT’s most recent earnings report, management reduced full year EBITDA guidance by 35%, one of the largest downward revisions to annual guidance in the Company’s history, and reduced Q4 EBITDA guidance by a stunning 76%.6 Does this meet leadership’s definition of being “conservative” and “responsible”? To us, this makes it appear as if the Company is simply incapable of delivering on its own promises or creating any stockholder value with the great assets that QUOT owns.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b889fd9e-84b2-4959-ac9b-99f30a10624f

QUOT’s inability to deliver for stockholders is further evidenced by the Company’s operational performance over the last five years. Despite the numerous strategic initiatives, investments and acquisitions, QUOT has not been able to deliver any fundamental improvement to operations. While the Company has grown revenue by ~$175 million over the past four years (an increase of over 50%), EBITDA has actually decreased by 20% or ~$10 million.7

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3ebc2866-492a-46d7-a8b9-b593583c1a30

Contributing to the Company’s drastic underperformance, we believe, is the fact that QUOT suffers from abysmal corporate governance practices that minimize accountability and serve to entrench the existing Board and management team, including the following:

Classified Board. The Board is classified into three separate classes, meaning the Company’s directors are only subject to re-election by stockholders once every three years. In our view, the ability of stockholders to select directors each year is an important check on the performance of the Board. It is critical in allowing stockholder input on the direction and state of the Company and ensuring the best individuals are on the Board to oversee their investment. To the contrary, the Board’s current classified structure impedes stockholders’ ability to regularly and effectively evaluate the performance of directors and insulates and entrenches the current Board members despite their apparent lapses in oversight.

Manipulation of Director Classes. While having a classified Board is bad enough, the Board manipulated the classes on which directors serve to further limit stockholders’ say on the composition of the Board. Specifically, Michelle McKenna served as a Class II director with a term expiring at the upcoming 2022 Annual Meeting at the time she resigned on July 30, 2021. However, her ostensible replacement appointed to the Board on the very same day, Alison Hawkins, joined as a Class I director with a term expiring at the 2024 Annual Meeting. In our view, this was a blatant entrenchment maneuver to reduce the number of candidates up for election at the 2022 Annual Meeting, which becomes even more apparent considering our efforts to constructively engage with the Company prior to such time.

4.9% NOL Pill. The NOL Pill entered into on November 11, 2021 effectively prohibits stockholders from acquiring 4.9% or more of the Company’s outstanding shares. While the Board claimed that the NOL Pill was adopted in order to protect against a possible limitation on the Company’s ability to use its net operating losses, we are not convinced its true purpose is not an anti-takeover device designed to further insulate the Board. The manner in which the NOL Pill extends to securities beyond beneficial ownership of common stock makes us even more skeptical as to its stated purpose.

Combined Chairman/CEO. Steven Boal serves as both the Chairman of the Board and the Chief Executive Officer of the Company. This is an antiquated practice that gives Mr. Boal outsized influence in the boardroom and creates an inherent conflict that we believe undermines the Board’s ability to effectively oversee management.

No Action by Written Consent or Ability to Call Special Meetings. Stockholders are prohibited from calling special meetings and cannot act by written consent, which in effect means that stockholders cannot seek Board change between annual meetings.

Supermajority Vote to Amend Bylaws and Restrictive Charter Provisions. In order for stockholders to amend the Bylaws, a prohibitively high supermajority vote of 66-2/3% of the outstanding shares is required. Similarly, in addition to Board approval, a supermajority vote of 66-2/3% of the outstanding shares is required to amend anti-stockholder provisions in the Charter such as the classified Board structure and inability of stockholders to call special meetings, act by written consent or fill vacancies on the Board, among others. The supermajority vote requirement significantly reduces stockholders’ ability to remediate these poor corporate governance practices.

Plurality Voting Standard in Uncontested Elections. The use of a plurality voting standard in uncontested elections reduces director accountability and entrenches the Board because it guarantees the election of the candidates nominated by the Board.

We find these governance provisions and tactics to be self-serving and an improper use of the Company’s corporate machinery to insulate the Board.

We specifically call on the Board to provide stockholders with evidence justifying the adoption of the draconian NOL Pill and prove that it is not just another entrenchment device. For starters, how close is the Company to experiencing an “ownership change,” as defined in Section 382 of the Internal Revenue Code of 1986, as amended?

In any event, Engaged Capital and its affiliates are formally seeking an exemption to the NOL Pill to permit the acquisition of up to 9,432,723 shares of common stock, representing 9.99% of the outstanding shares. The formal request in accordance with the requirements of Section 32 of the NOL Pill is being delivered under a separate cover letter to the Company. If the NOL Pill’s purpose is truly to protect against a possible limitation on the Company’s ability to use its net operating losses, we expect our request to be promptly granted. Any denial of our request will further confirm our belief that the true purpose of the NOL Pill is an anti-takeover device designed to further insulate the Board.

To be clear, Engaged Capital does not take control positions in companies. We just want to be able to invest a reasonable amount of capital into QUOT given we believe the Company is trading well below its intrinsic value. Given the Company’s cash balance, we do not expect that you have any need to raise capital but to the extent QUOT requires additional capital to finally execute and deliver value for stockholders, Engaged Capital would be willing to make a strategic investment in the Company.

This Board must finally act decisively to change the Company’s direction. We believe QUOT has significant potential to create value with its access to detailed data sets and insights, deep partner relationships and strong technology-based solutions. QUOT competes in a competitive marketplace and if the Company remains oblivious to the issues in need of correction and continues to be managed for profitless growth, every director in this boardroom will be held accountable by stockholders. It is not too late to change the Company’s direction. There are valuable assets in QUOT – assets that other peers and competitors would find highly attractive if the Company is unable to drive profitable growth and the Board is finally open to other paths for value creation. We believe it is time for the Board to act as good fiduciaries and look for alternative ways that QUOT can deliver on the promises made to stockholders over the last seven years.

As a follow up to this letter and with the goal of maintaining a constructive dialogue, we respectfully request a call with a subset of the independent directors of the Board to discuss these important matters further.

Best Regards,

/s/ Glenn W. Welling

Glenn W. Welling

Founder and Chief Investment Officer

Engaged Capital, LLC

About Engaged Capital:

Engaged Capital, LLC (“Engaged Capital”) is an investment advisor with a private equity-like investing style in the U.S. public equity markets. Engaged Capital seeks to help build sustainable businesses that create long-term shareholder value by engaging with and bringing an owner’s perspective to the managements and boards of undervalued public companies and working with them to unlock the embedded value within their businesses. Engaged Capital manages approximately $1.5 billion of institutional capital with a focus on delivering superior, long-term, risk-adjusted returns for our limited partners. Engaged Capital was established in 2012 and is based in Newport Beach, California. Learn more at www.engagedcapital.com.

Investor Contact:

Engaged Capital, LLC

Glenn W. Welling, 949-734-7900

Media Contact:

Gagnier Communications

Dan Gagnier, 646-569-5897

dg@gagnierfc.com

______________________

1 FactSet as of 11/16/2021

2 FactSet as of 11/16/2021; Peers’ TSR is the average across current publicly traded companies listed in QUOT’s 2021 Proxy Statement peer group including: BNFT, BOX, EGHT, FIVN, LPSN, QNST, QTWO, RPD, SPSC, SSTK, TRUE, TTD, TWOU, YELP

3 FactSet as of 11/16/2021

4 QUOT filings with the Securities and Exchange Commission

5 Q4’20 Earnings Transcript

6 “Prior Guidance” is defined as the midpoint of the guidance range provided or implied in Q2’21; “New Guidance” is defined as the midpoint of the guidance range provided in Q3’21

7 FY21E Revenue and EBITDA based on midpoint of guidance range provided in Q3’21