Eni (E) Q4 Earnings Beat Estimates on High Liquid & Gas Prices

Eni SpA E reported fourth-quarter 2021 adjusted earnings from continuing operations of $1.33 per American Depository Receipt (ADR), beating the Zacks Consensus Estimate of $1.30. The bottom line significantly increased from the year-ago quarter’s 5 cents per ADR.

Total revenues in the quarter were $30,965 million, up from $14,237 million a year ago.

The strong quarterly results were attributed to higher realizations of average liquids and natural gas prices.

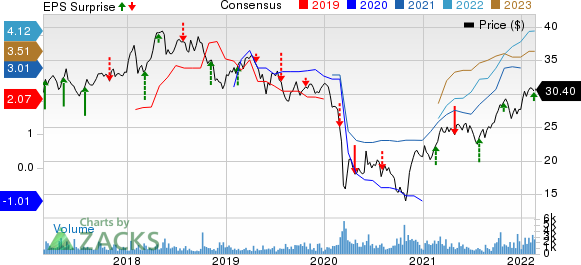

Eni SpA Price, Consensus and EPS Surprise

Eni SpA price-consensus-eps-surprise-chart | Eni SpA Quote

Operational Performance

The company operates through four business segments — Exploration & Production, Global Gas & LNG Portfolio, Refining & Marketing and Chemicals, and EGL, Power & Renewables.

Exploration & Production

Total oil and gas production for the fourth quarter was 1,737 thousand barrels of oil equivalent per day, up 1.4% year over year.

Liquids production was 852 thousand barrels per day (MBbl/d), up 5.3% from the year-ago level of 809 MBbl/d. Natural gas production dropped 2% year over year to 4,700 million cubic feet per day.

The average realized price of liquids was $75.71 per barrel, up 82% from $41.57 reported a year ago. Realized natural gas price was $9.96 per thousand cubic feet, up 154% from $3.92 a year ago.

Higher realizations of average liquids and natural gas prices aided the company’s Exploration & Production segment. The segment reported a profit of €3,640 million, which skyrocketed from €802 million recorded in the December-end quarter of 2020.

Global Gas & LNG Portfolio

Eni’s worldwide sales of natural gas for the December-end quarter were recorded at 18.88 billion cubic meters (bcm), up 2% year over year.

The integrated energy major’s Global Gas & LNG Portfolio business segment reported an adjusted operating profit of €536 million, turning around from the year-ago loss of €101 million. The continuous initiatives of portfolio optimization aided the segment.

Refining & Marketing and Chemicals

For the December-end quarter, total refinery throughputs were recorded at 6.96 million tons (mmtons), up 9% year over year. Petrochemical product sales declined 17% year over year to 1.11 mmtons for the fourth quarter of 2021.

For the quarter under review, the segment reported an adjusted loss of €105 million, wider than the loss of €104 million in the year-ago quarter primarily due to lower production in the Chemicals segment.

EGL, Power & Renewables

Retail gas sales, managed by Eni gas e luce (“EGL”), increased 5% year over year to 2.62 bcm. EGL is an energy retail company that is controlled entirely by Eni. Power sales in the open market improved 18% year over year.

Overall, from EGL, Power and Renewables, the company reported a profit of €97 million, reflecting a 27% year-over-year decline.

Financials

As of Dec 31, Eni had long-term debt of €23,714 million, and cash and cash equivalents of €8,254 million. Its debt to capitalization was 38.3%.

For the reported quarter, net cash generated by operating activities amounted to €5,825 million. Capital expenditure totaled €1,674 million.

Zacks Rank & Other Stocks to Consider

The company flaunts a Zacks Rank #1 (Strong Buy).

Investors interested in the energy sector might look at the following stocks that reported solid fourth-quarter earnings numbers and also presently sport a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

ConocoPhillips COP, based in Houston, TX, is primarily involved in the exploration and production of oil and natural gas. COP recently reported fourth-quarter 2021 adjusted earnings per share of $2.27, comfortably beating the Zacks Consensus Estimate of $2.20.

ConocoPhillips’ earnings for 2022 are expected to soar 62.1% year over year. COP reported preliminary 2021 year-end proved reserves at 6.1 billion Boe. As of Dec 31, 2021, ConocoPhillips had $5,028 million in total cash and cash equivalents.

Marathon Oil Corporation MRO is a leading oil and natural gas exploration and production company with operations in the United States and Africa. MRO reported fourth-quarter 2021 adjusted net income per share of 77 cents, comprehensively beating the Zacks Consensus Estimate of 55 cents.

Marathon Oil’s earnings for 2022 are expected to surge 75.8% year over year. In good news for investors, the company is using the excess cash from a supportive environment to reward them with dividends and buybacks. As part of that, MRO has executed $1 billion of share repurchases since October (with $1.7 billion remaining under the current authorization) and recently announced a dividend hike.

Marathon Petroleum Corporation MPC is a leading independent refiner, transporter and marketer of petroleum products. MPC reported fourth-quarter 2021 adjusted earnings of $1.30 per share, which comfortably beat the Zacks Consensus Estimate of 47 cents.

Marathon Petroleum is expected to see an earnings growth of 129.8% in 2022. As of Dec 31, MPC had cash and cash equivalents of $5.3 billion. Marathon Petroleum repurchased shares worth $3 billion in the October-January period and has now completed around 55% of its target to buy back $10 billion in common stock.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ConocoPhillips (COP) : Free Stock Analysis Report

Marathon Oil Corporation (MRO) : Free Stock Analysis Report

Eni SpA (E) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research