Eni (E) Signs Agreement to Increase Gas Production in Libya

Eni SpA E entered an agreement with Libya’s National Oil Corporation to develop the Structures A&E project, which is designed to increase gas production to supply the Libya market and ensure export to Europe.

Structures A&E is believed to be the first major project in Libya in more than two decades. The project will involve two gas fields, located in the contractual area D offshore Libya.

The gas will be produced through two main platforms tied to existing treatment facilities at the Mellitah Complex. Production from the fields is expected to reach a plateau production of 750 million standard gas cubic feet a day. Production is expected to commence in 2026.

The project also includes the development of a carbon capture and storage facility at Mellitah. This will significantly reduce the overall carbon footprint, in line with Eni’s decarbonization strategy. The deal will have a duration of 25 years, with an estimated investment of $8 billion.

Eni has been contributing to Libya’s growth since 1959, with a share of 80% of the national production. The deal will enable important investments in Libya’s energy sector. This will support local development and job creation, while strengthening the company’s role as a leading operator in the country.

Libya authorities have been working to secure major investments in their energy industry. The country managed to significantly boost production over the past year and is planning to reach 1.6 million barrels per day. The project will have a major influence on the industry and the associated supply chain, marking a significant contribution to the Libya economy.

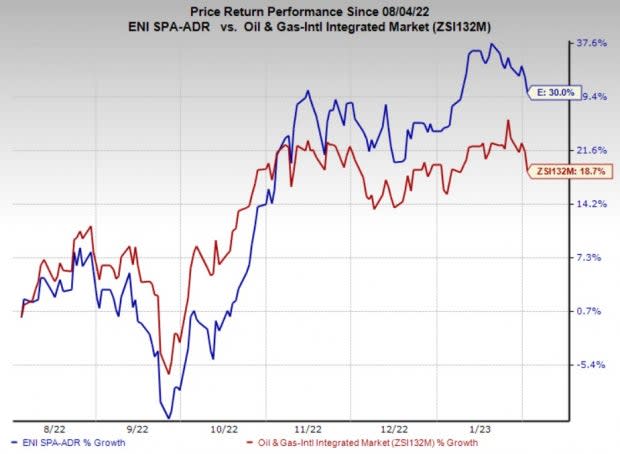

Price Performance

Shares of Eni have outperformed the industry in the past six months. The stock has gained 30% compared with the industry’s 18.7% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Eni currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Halliburton Company HAL reported a fourth-quarter 2022 adjusted net income per share of 72 cents, surpassing the Zacks Consensus Estimate of 67 cents. The outperformance reflects stronger-than-expected profit from both its divisions.

HAL is expected to see earnings growth of 43.7% in 2023. In more good news for investors, Halliburton raised its quarterly dividend by 33.3% to 16 cents per share (or 64 cents per share annualized).

Valero Energy Corporation VLO reported fourth-quarter 2022 adjusted earnings of $8.45 per share, beating the Zacks Consensus Estimate of $7.45 per share. The strong quarterly results were driven by increased refinery throughput volumes and a higher refining margin.

Valero can benefit from the Gulf Coast export volumes as fuel demand recovery gets support from Asia economies. The Gulf Coast contributed 59.4% to the total throughput volume in the fourth quarter of 2022.

Liberty Energy Inc. LBRT announced fourth-quarter 2022 earnings per share of 82 cents, which handily beat the Zacks Consensus Estimate of 71 cents. The outperformance reflects the impact of strong execution and increased service pricing.

LBRT is expected to see an earnings surge of 61.1% in 2023. As part of its shareholder return policy, LBRT repurchased $125 million of its stock at an average price of $15.29 apiece since July and reinstated a quarterly cash dividend of 5 cents in the fourth quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Halliburton Company (HAL) : Free Stock Analysis Report

Eni SpA (E) : Free Stock Analysis Report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report