Enphase (ENPH) Witnesses Increased Product Deployment in Utah

Enphase Energy, Inc.ENPH registers increased deployments of its Enphase Energy System, powered by IQ8 microinverters, in Utah, reflecting the growing demand for its products. The reliability, sustainability and high resiliency that Enphase’s products deliver to customers make it a top choice among homeowners for energy independence.

This continues to assist the company in maintaining a leading position as a microinverters supplier and capitalizing on the same across the United States. Prior to this development, the company recorded increased deployment for the Enphase Energy System in Pennsylvania.

Backed by such a strong deployment count, Enphase may continue to record strong growth in sales as the nation gradually moves towards renewables to curtail climate concerns.

Enphase Growth Momentum in Microinverters

Enphase enjoys a strong growth momentum in microinverters as it strives to provide customers with technologically advanced products, which suit the evolving needs of consumers in the solar space.

In this context, Enphase’s latest IQ8 microinverter is a high-quality product that boasts features of advanced technology while enabling consumers to monitor and manage their energy needs thoroughly. IQ8 microinverter provides sunlight backup during an outage, even without a battery.

No doubt, such continued advancements in product technology have enabled the company to increase its customer base and bolster its revenue growth. As of Dec 31, 2022, the company sold approximately 15.4 million microinverter units compared with nearly 10.4 million units for the year ended Dec 31, 2021. The company recorded $133 million increase in revenue, mainly due to more sales of IQ8 microinverters, in 2022.

ENPH may continue to witness strong momentum in microinverter demand which would enable the company to expand its footprint in the solar space.

Global Solar Market Boom

The solar energy market continues to expand as nations across the globe continue to gradually move towards renewable sources of energy to curb their carbon footprint. Also, various government incentive and rebates to encourage the adoption is fueling the expansion. Moreover, the declining solar technology cost makes it more affordable for consumers amid the rising energy cost.

All these driving factors support the expansion of the solar market. Per the report from Mordor Intelligence, the global solar energy market is expected to grow at a CAGR of 12.7% during 2023-2028 period. Such growth prospects in the solar market should benefit Enphase, which already enjoys a strong footing in the solar energy space.

Enphase apart, other solar players that are expected to benefit from the growing solar market are:

In March 2023,Canadian Solar Inc.CSIQ announced that its three solar projects in Japan, Oita Kitsuki, Gunma Takasaki, and Yamaguchi Hofu, boasting a capacity of 42 Megawatt-peak (MWp), will begin their operation in the first quarter of 2023. The 53,000 MWh energy generated from the three projects would be enough to power over 15,000 households.

The Zacks Consensus Estimate of Canadian Solar’s 2023 earnings suggest a growth rate of 142.5% from the prior-year reported figure. CSIQ shares have increased 37.1% in the past year.

In Feb 2023,SolarEdge SEDG entered into a multi-year agreement with Freedom Forever for the supply of residential smart energy products and solutions across the United States.

SolarEdge’s long-term earnings growth rate is pegged at 31%. SEDG shares have increased 5.9% in the past month.

In Jan 2023, First Solar FSLR completed the sale of Luz del Norte, a 141-megawatt (MW) AC utility-scale solar power plant in Copiapó, Chile, to Toesca, an independent asset manager headquartered in Las Condes, Chile.

The Zacks Consensus Estimate of FSLR’s 2023 sales suggest a growth rate of 33.3% from the prior year reported figure. First Solar shares have rallied 182.8% in the past year.

Price Movement

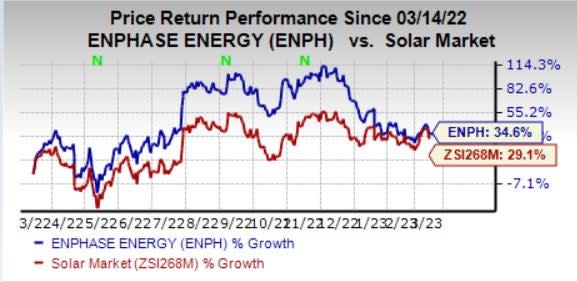

In the past year, shares of Enphase Energy have soared 34.6% compared with the industry’s growth of 29.1%.

Image Source: Zacks Investment Research

Zacks Rank

Enphase Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Solar, Inc. (FSLR) : Free Stock Analysis Report

Canadian Solar Inc. (CSIQ) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report