Ensign Energy Services Inc (TSE:ESI): Dividend Is Coming In 3 Days, Should You Buy?

Investors who want to cash in on Ensign Energy Services Inc’s (TSX:ESI) upcoming dividend of CA$0.12 per share have only 3 days left to buy the shares before its ex-dividend date, 19 December 2017, in time for dividends payable on the 04 January 2018. Should you diversify into Ensign Energy Services and boost your portfolio income stream? Well, keep on reading because today, I’m going to look at the latest data and analyze the stock and its dividend property in further detail. See our latest analysis for Ensign Energy Services

5 checks you should use to assess a dividend stock

Whenever I am looking at a potential dividend stock investment, I always check these five metrics:

Is their annual yield among the top 25% of dividend payers?

Has it consistently paid a stable dividend without missing a payment or drastically cutting payout?

Has dividend per share risen in the past couple of years?

Is its earnings sufficient to payout dividend at the current rate?

Based on future earnings growth, will it be able to continue to payout dividend at the current rate?

Does Ensign Energy Services pass our checks?

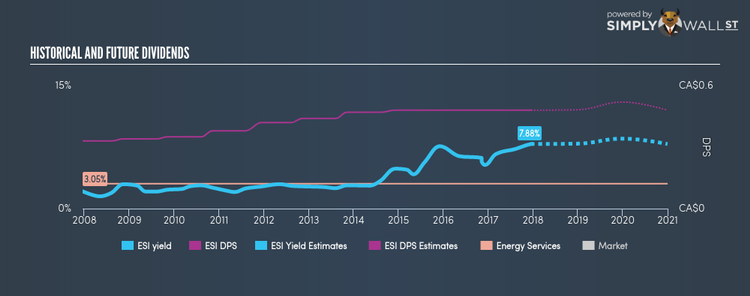

The current payout ratio for ESI is negative, which means that it is loss-making, and paying its dividend from its retained earnings. If there’s one type of stock you want to be reliable, it’s dividend stocks and their stable income-generating ability. In the case of ESI it has increased its DPS from CA$0.33 to CA$0.48 in the past 10 years. It has also been paying out dividend consistently during this time, as you’d expect for a company increasing its dividend levels. This is an impressive feat, which makes ESI a true dividend rockstar. Relative to peers, Ensign Energy Services has a yield of 7.88%, which is high for energy services stocks.

What this means for you:

Are you a shareholder? With Ensign Energy Services producing strong dividend income for your portfolio over the past few years, you can take comfort in knowing that this stock will still continue to be a robust dividend generator moving forward. But, depending on your current portfolio, it may be valuable exploring other income stocks to increase diversification, or even look at high-growth stocks to complement your steady income stocks. I encourage you to continue your research by exploring my interactive free list of dividend rockstars as well as high-growth stocks to potentially add to your holdings.

Are you a potential investor? Considering the dividend attributes we analyzed above, Ensign Energy Services is definitely worth keeping an eye on for someone looking to build a dedicated income portfolio. As always, I urge potential investors to try and get a good understanding of the underlying business and its fundamentals before deciding on an investment. Whether or not you like Ensign Energy Services as a dividend stock, it’s still worth checking the price tag. Is Ensign Energy Services overvalued or is it actually a bargain? Dig deeper in our latest free analysis to find out!

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.