EPAM Systems (EPAM) Q4 Earnings Top Estimates, Sales Match

EPAM Systems EPAM reported mixed fourth-quarter 2022 results. The company’s fourth-quarter non-GAAP earnings of $2.93 per share beat the Zacks Consensus Estimate of $2.68. The figure improved by 6.2% year over year.

Revenues were $1.23 billion, which matched the Zacks consensus mark, reflecting a year-over-year increase of 11.2%. On a constant-currency (cc) basis, top line was up 14.4%. Acquisitions completed in the last 12 months contributed 1.5% to the fourth quarter top line.

Digital transformation, a focus on customer engagement and product development remained key catalysts. The company continued to benefit from growth across multiple industry verticals and all geographies except for the Central and Eastern Europe (CEE) region.

EPAM’s fourth-quarter performance in the CEE was hurt by massive business disruptions caused by the Russia-Ukraine war. In February 2022, the company announced the discontinuation of its services in Russia in support of Ukraine. The decision to exit the Russian market negatively impacted total fourth-quarter revenues by 4.4%.

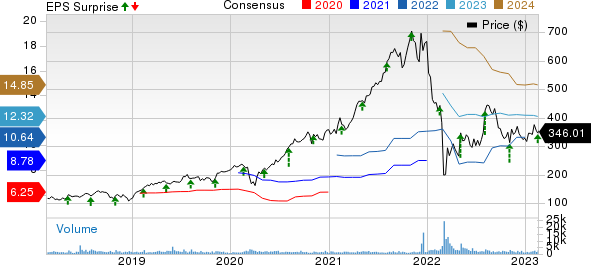

EPAM Systems, Inc. Price, Consensus and EPS Surprise

EPAM Systems, Inc. price-consensus-eps-surprise-chart | EPAM Systems, Inc. Quote

Quarterly Details

Segment-wise, Business Information & Media climbed 10.9% year over year to $208.9 million and accounted for 17% of the company’s revenues.

Financial Services jumped 2.4% on a year-over-year basis to $260.9 million and accounted for 21.2% of revenues.

While Software & Hi-Tech was up 10.3% to $203 million, Travel & Consumer grew 16% to $270.2 million. Software & Hi-Tech and Travel & Consumer accounted for 16.5% and 21.9% of revenues, respectively.

Life Science & Healthcare climbed 11.5% year over year to $125.4 million and accounted for 10.2% of revenues. The Emerging segment improved by 20.8% year over year to $162.9 million and contributed 13.2% to revenues.

Geography-wise, EPAM generated 59.4% of the total revenues from the Americas, up 14.7% year over year. Revenues from the EMEA, contributing 36.9% to total revenues, jumped 18% year over year.

The Asia Pacific remained flat year over year while accounting for 2.4% of revenues. The CEE, representing 1.3% of revenues, plunged 71.8% year over year.

The total headcount was approximately 59,300 as of Dec 31, 2022.

EPAM’s non-GAAP gross profit climbed 5.7% to $419.8 million, while the gross margin contracted 180 basis points (bps) to 34.1%. The non-GAAP operating income increased 6.4% year over year to $219.6 million. The non-GAAP operating margin contracted by 80 bps to 17.8%.

Balance Sheet and Cash Flow

As of Dec 31, 2022, EPAM had cash, cash equivalents and restricted cash of $1.68 billion, up from $1.45 billion as of Sep 30, 2022.

As of Dec 31, 2022, the long-term debt was $27.7 million, down from $28.2 million as of Sep 30, 2022.

In the fourth quarter, EPAM generated operating and free cash flows of $186.1 million and $164.6 million, respectively. During full year 2023, the company generated $464.1 million worth cash from operating activities and $382.5 million worth free cash flow.

The company’s Board of Directors recently approved share repurchase authorization of up to $500 million with a term of 24 months.

Full-Year Highlights

For full-year 2022, EPAM reported revenues of $4.83 billion, up 28.4% year over year. On a cc basis, revenues increased 32.4%.

The company reported non-GAAP earnings of $10.90 per share, reflecting a year-over-year surge of 20.4%.

The non-GAAP operating income climbed 20.6% to $818.2 million. Non-GAAP operating margin contracted 100 bps to 17%.

Guidance

EPAM provided guidance for the first quarter of 2023. The company estimates reporting GAAP revenues between $1.200 billion and $1.210 billion, suggesting year-over-year growth of at least 3% at the midpoint in the first quarter.

EPAM expects foreign currency translation to have a negative impact of 2%. On a cc basis, it projects revenue growth of around 5%. The company forecasts that the exit from the Russian market is likely to hurt first-quarter revenues by approximately 3%.

Management projects the non-GAAP operating margin in the 14-15% range. Non-GAAP earnings are expected in the range of $2.30-$2.38 per share, which indicates a year-over-year decline of 6% at the midpoint.

For 2023, the company projects revenues of at least $5.250 billion, suggesting growth of at least 9% on a reported basis. This includes a minimal unfavorable impact of foreign currency translation on revenues. EPAM expects the exit from the Russian market to impact 2023 revenues by approximately 2%.

EPAM sets non-GAAP earnings guidance to the $11.15-$11.35 per share range, suggesting year-over-year growth of 3% at the midpoint in fiscal 2023.

The company forecasts its non-GAAP operating margin guidance between 15.5% and 16.5% for 2023.

Zacks Rank & Key Picks

Epam Systems carries a Zacks Rank #3 (Hold). Shares of EPAM have dropped 21.6% over the past year.

Some top-ranked stocks from the broader Computer and Technology sector are Baidu BIDU, Fabrinet FN and Bandwidth BAND. While Baidu and Fabrinet sport a Zacks Rank #1 (Strong Buy), Bandwidth carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Baidu’s fourth-quarter 2022 earnings has been revised 49 cents southward to $2.14 per share over the past 30 days. For 2022, earnings estimates have dropped by 3.4% to $8.64 per share over the past 30 days.

BIDU’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 50.2%. Shares of the company have lost 10.5% in the past year.

The Zacks Consensus Estimate for Fabrinet's third-quarter fiscal 2023 earnings has been revised 7 cents upward to $1.90 per share over the past seven days. For fiscal 2023, earnings estimates have moved north by 24 cents to $7.71 per share in the past seven days.

FN’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, missing once, the average surprise being 5.1%. Shares of the company have jumped 20.8% in the past year.

The Zacks Consensus Estimate for Bandwidth’s fourth-quarter 2022 earnings has been revised by a penny to 4 cents per share over the past 90 days. For 2022, earnings estimates have moved north by 5 cents to 37 cents per share in the past 90 days.

BAND's earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 301.8%. Shares of the company have declined 52.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

EPAM Systems, Inc. (EPAM) : Free Stock Analysis Report

Fabrinet (FN) : Free Stock Analysis Report

Bandwidth Inc. (BAND) : Free Stock Analysis Report