With EPS Growth And More, Ally Financial (NYSE:ALLY) Is Interesting

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Ally Financial (NYSE:ALLY). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Ally Financial

How Fast Is Ally Financial Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. I, for one, am blown away by the fact that Ally Financial has grown EPS by 39% per year, over the last three years. That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

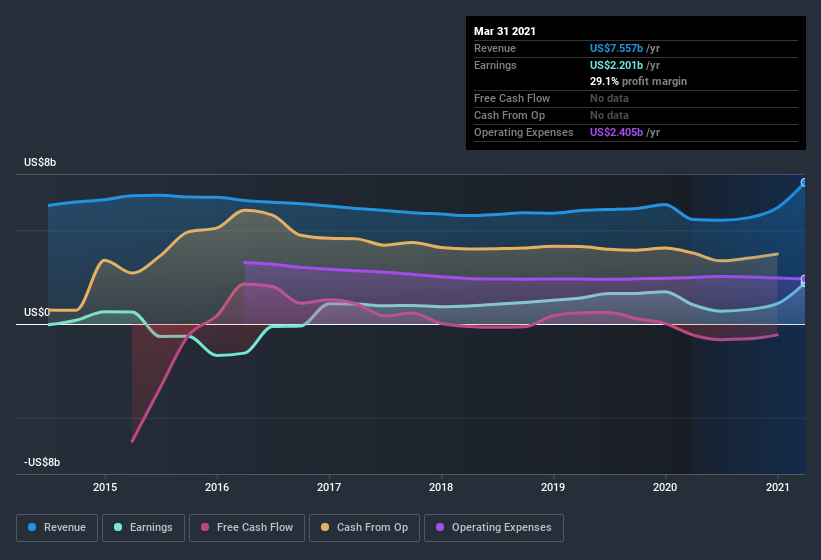

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that Ally Financial's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Ally Financial's EBIT margins were flat over the last year, revenue grew by a solid 36% to US$7.6b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Ally Financial's forecast profits?

Are Ally Financial Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$18b company like Ally Financial. But we do take comfort from the fact that they are investors in the company. With a whopping US$62m worth of shares as a group, insiders have plenty riding on the company's success. That's certainly enough to make me think that management will be very focussed on long term growth.

Is Ally Financial Worth Keeping An Eye On?

Ally Financial's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So yes, on this short analysis I do think it's worth considering Ally Financial for a spot on your watchlist. You still need to take note of risks, for example - Ally Financial has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.