With EPS Growth And More, CoStar Group (NASDAQ:CSGP) Is Interesting

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in CoStar Group (NASDAQ:CSGP). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for CoStar Group

CoStar Group's Improving Profits

In the last three years CoStar Group's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, CoStar Group's EPS shot from US$4.48 to US$7.51, over the last year. Year on year growth of 68% is certainly a sight to behold.

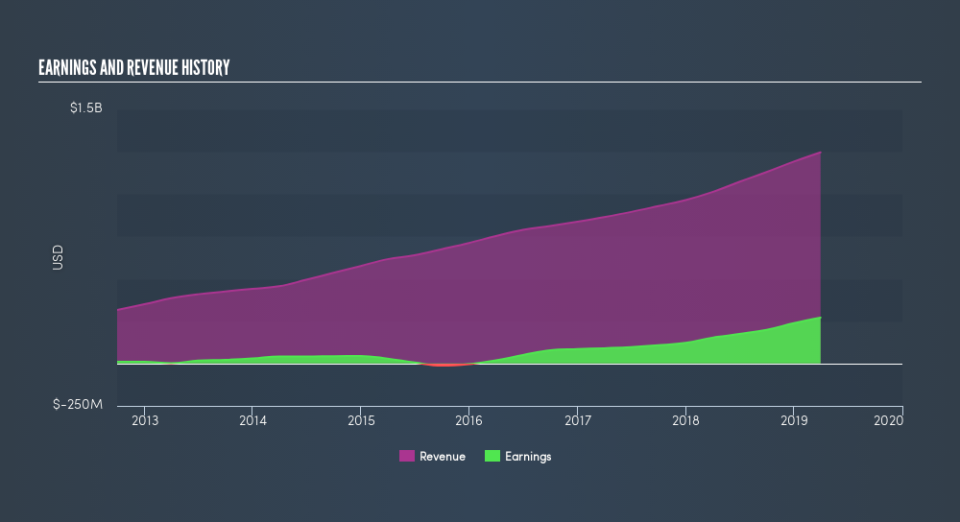

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. CoStar Group shareholders can take confidence from the fact that EBIT margins are up from 20% to 25%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for CoStar Group.

Are CoStar Group Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$21b company like CoStar Group. But we are reassured by the fact they have invested in the company. Indeed, they have a glittering mountain of wealth invested in it, currently valued at US$383m. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

Does CoStar Group Deserve A Spot On Your Watchlist?

CoStar Group's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So yes, on this short analysis I do think it's worth considering CoStar Group for a spot on your watchlist. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how CoStar Group shapes up to industry peers, when it comes to ROE.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.