With EPS Growth And More, Dream Industrial Real Estate Investment Trust (TSE:DIR.UN) Is Interesting

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Dream Industrial Real Estate Investment Trust (TSE:DIR.UN). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Dream Industrial Real Estate Investment Trust

How Fast Is Dream Industrial Real Estate Investment Trust Growing Its Earnings Per Share?

In the last three years Dream Industrial Real Estate Investment Trust's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a wedge-tailed eagle on the wind, Dream Industrial Real Estate Investment Trust's EPS soared from CA$1.10 to CA$1.48, in just one year. That's a impressive gain of 34%.

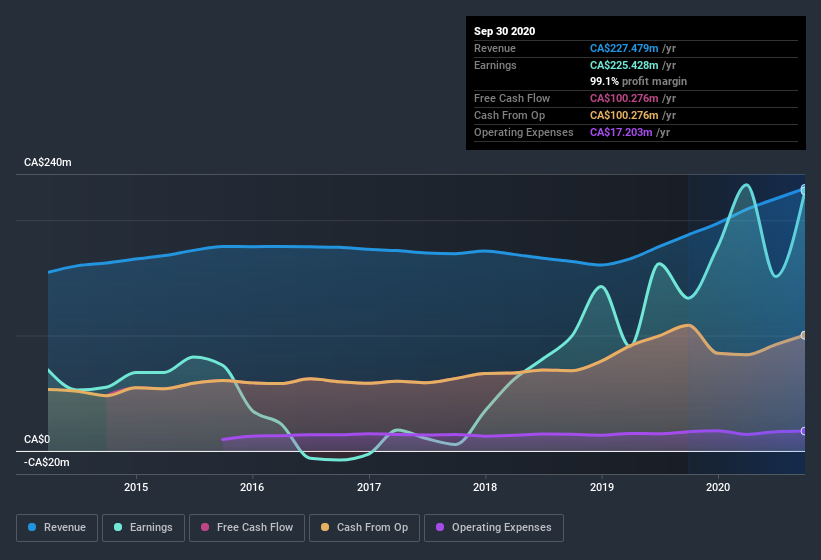

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Dream Industrial Real Estate Investment Trust's EBIT margins were flat over the last year, revenue grew by a solid 21% to CA$227m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Dream Industrial Real Estate Investment Trust Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. As a result, I'm encouraged by the fact that insiders own Dream Industrial Real Estate Investment Trust shares worth a considerable sum. Indeed, they hold CA$16m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 0.7% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. A brief analysis of the CEO compensation suggests they are. I discovered that the median total compensation for the CEOs of companies like Dream Industrial Real Estate Investment Trust with market caps between CA$1.3b and CA$4.1b is about CA$2.7m.

The CEO of Dream Industrial Real Estate Investment Trust only received CA$1.1m in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Dream Industrial Real Estate Investment Trust To Your Watchlist?

For growth investors like me, Dream Industrial Real Estate Investment Trust's raw rate of earnings growth is a beacon in the night. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. Each to their own, but I think all this makes Dream Industrial Real Estate Investment Trust look rather interesting indeed. It's still necessary to consider the ever-present spectre of investment risk. We've identified 6 warning signs with Dream Industrial Real Estate Investment Trust (at least 2 which don't sit too well with us) , and understanding these should be part of your investment process.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.