Equifax (EFX) Gains From Acquisitions, High Debt Woes Hurt

Equifax, Inc. EFX has been providing application processing of new credit cards, automobile loans, home and equity loans, and other consumer loans by using credit information and related analytical services and data. The company has beaten the Zacks Consensus Estimate for earnings in all four preceding quarters.

Equifax reported better-than-expected first-quarter 2023 results. Adjusted earnings (excluding 52 cents from non-recurring items) came in at $1.43 per share, beating the consensus mark by 4.4% but declining 35.6% from the year-ago figure.

Total revenues of $1.3 billion surpassed the consensus estimate by 1.5% but decreased 4.5% on a reported basis from the year-ago figure. The top line was down 3% on a local currency basis.

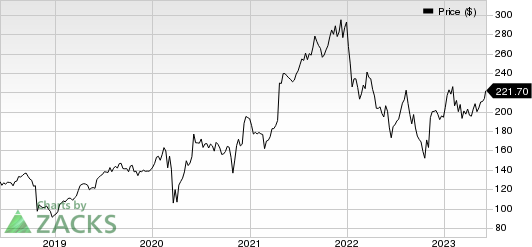

The company’s stock has outperformed its Financial Transaction Services market in the past year, partly driven by these tailwinds. EFX has grown 13% in the past year against its industry’s 2.2% dip. The S&P 500 composite index has increased 4.5%.

Equifax, Inc. Price

Equifax, Inc. price | Equifax, Inc. Quote

Current Situation of Equifax

Equifax has been active on the buyback front, strategically acquiring and supplementing its core business. The recent acquisition of Efficient Hire, which is now part of Equifax’s Workforce Solutions business unit, expands the company's portfolio of employer- and HR-focused solutions, boosting its ability to help clients manage their hiring and employment needs. These acquisitions help the company to gain insight into consumer performance, financial status, capabilities of customers and market opportunities. Equifax has been on a continuous lookout to expand its customer base by providing differentiated data assets and analytics through organic growth, mergers and acquisitions, and partnerships.

Equifax caters to a wide range of industries including financial, mortgage, consumer, employees, telecommunications and automotive among others. Its use of credit information and related analytical services and data to process applications for new credit cards, automobile loans, home and equity loans and other consumer loans are trusted by its customers and is a major driver of the company’s success.

Equifax's current ratio at the end of first-quarter 2023 was pegged at 0.77, higher than the current ratio of 0.54 reported at the end of the prior-year quarter. It indicates that the company may not have problems meeting its short-term debt obligations.

Some Concerning Points

Equifax’s revenues have been impacted by seasonality with the USIS segment’s revenues being the lowest during the first quarter of each year as consumer lending activity remains at a seasonal low. However, the revenues from the Employer Services business unit in the Workforce Solutions segment are the highest during the first quarter. Equifax also has more current debt as compared to cash and cash equivalents.

Zacks Rank and Stocks to Consider

EFX currently carries a Zacks Rank #3 (Hold).

Investors interested in the Zacks Business Services sector can consider the following stocks:

Green Dot GDOT: For second-quarter 2023, the Zacks Consensus Estimate of Green Dot’s revenues suggests a decline of 4.5% year over year to $339.2 million and the same for earnings indicates a 56.8% plunge to 32 cents per share. The company has an impressive earning surprise history, beating the consensus mark in all four trailing quarters, the average surprise being 37.3%.

GDOT has a Value score of A and currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Maximus MMS: For second-quarter 2023, the Zacks Consensus Estimate of Maximus’ revenues suggests an increase of 6.1% year over year to $1.2 billion and the same for earnings indicates a 46.2% rise to $1.14 per share. The company has an impressive earning surprise history, beating the consensus mark in three instances and missing on one instance, the average surprise being 9.6%.

Currently, MMS has a VGM score of A and a Zacks Rank of 1.

Rollins ROL: For second-quarter 2023, the Zacks Consensus Estimate of Rollins’ revenues suggests growth of 12.8% year over year to $805.2 million and the same for earnings indicates a 15% increase to 23 cents per share. The company has an impressive earning surprise history, beating the consensus mark in three of the four trailing quarters and missing on one instance, the average surprise being 5.53%.

ROL currently carries a Zacks Rank of 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report