Equity ETFs Gathering Plenty of Cash in July

So much for the summer doldrums. The Dow Jones Industrial Average is sitting on a triple-digit gain, having earlier touched a new intraday record high during Monday’s trading session.

While the S&P 500 has another eight points to go to get back to its record high touched on July 3, July has been a strong month for U.S. equities. That much is confirmed by investors’ appetite for equity exchange traded funds, reversing a trend seen earlier this year when bond funds dominated inflows. [Q2 ETF Flows Firm Up]

“ETF investors are bullish on U.S. equities, with YTD flows of $25.7 billion and $5.9 billion in the 9 days of the new month. The story flips when it comes to fixed income products, with bond mutual funds receiving $52.9 billion YTD and a steady $2-4 billion/week over the last four weeks. ETF investors are net sellers of bonds – $2.4 billion out since the beginning of July and $5.6 billion in the last month,” said Nicholas Colas,chief market strategist at ConvergEx Group, a global brokerage company based in New York, in a note out Monday.

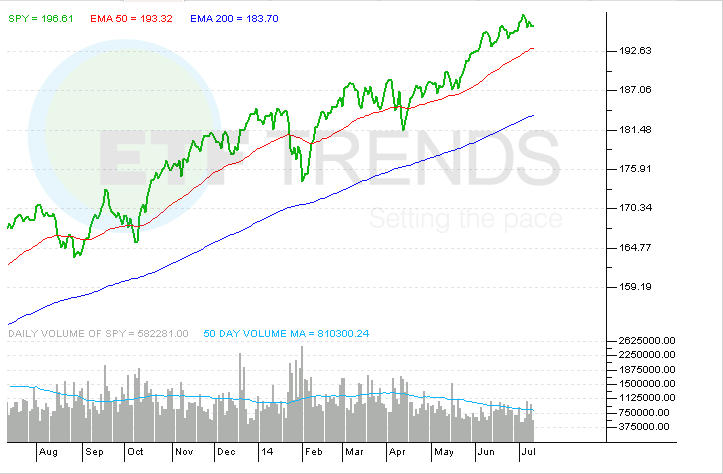

While the Vanguard Total Bond Market ETF (BND) and the iShares Core U.S. Aggregate Bond ETF (AGG) remain among the top-10 asset gathering ETFs on a year-to-date basis, no bond funds are among the top-10 third-quarter asset gatherers. That group is led by the SPDR S&P 500 ETF (SPY) . The world’s largest ETF has added $4.2 billion since the start of this month.

“U.S. stocks are the winners of the ETF money flow derby, with $18.9 billion in money flows over the last month and $5.9 billion in July. That is 86% and 81% of the totals mentioned in the prior bullet. Fixed income products, by contrast, are net losers. In July alone, ETF investors have pulled $2.4 billion out of bond products, and $5.6 billion over the past month,” added Colas.

Other top-10 asset gatherers since the start of July include the iShares Core S&P Mid-Cap ETF (IJH) , PowerShares QQQ (QQQ) and the iShares MSCI Emerging Markets ETF (EEM) . No ETF gained more new capital than the nearly $6 billion added by EEM in the second quarter. That helped BlackRock’s (BLK) iShares lead all ETF issuers in second-quarter flows. [iShares Leads Q2 ETF Flows]

Three bond ETFs are found among the biggest losers of assets since the start of July. With outflows of nearly $1.7 billion, the iShares 7-10 Year Treasury Bond ETF (IEF) tops that list. That is a reversal of fortune for an ETF that has spent much of 2014 as one of the best asset-gathering funds.

“The surprise winners in terms of ETF money flows YTD are commodities funds. While not as large an AUM group as stocks or bonds, commodity ETFs are up,” said Colas.

Since the start of July, the SPDR Gold Shares (GLD) has added $407.7 million in new assets while the Market Vectors Gold Miners ETF (GDX) and the Market Vectors Junior Gold Miners ETF (GDXJ) have combined for $253 million of inflows. [Seasonality Favors Gold ETFs]

SPDR S&P 500 ETF

Tom Lydon’s clients own shares of AGG, EEM, GLD, QQQ and SPY.