Esperion (ESPR) Up More Than 12% YTD: What's Driving the Rally?

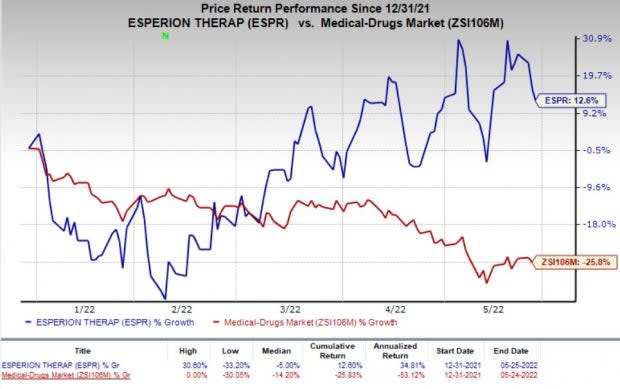

Shares of Esperion Therapeutics ESPR have gained 12.6% so far this year, primarily driven by strong demand for its marketed drugs. The Zacks Medical - Drugs industry has declined 25.8% in the same period.

Image Source: Zacks Investment Research

Esperion has two FDA-approved drugs — Nexletol and Nexlizet — in its commercial portfolio approved for treating elevated LDL-C (bad cholesterol). These two drugs are marketed as Nilemdo and Nustendi in Europe and several other ex-U.S. markets in partnership with Daiichi Sankyo. Esperion records direct sales of Nexletol and Nexlizet in the United States as product revenues and records royalty on sales of its drugs in Europe and other ex-U.S. markets.

During the first quarter of 2022, product revenues gained 109% year over year driven by robust demand for Nexletol and Nexlizet. Product revenues were up 9.8% sequentially. These drugs witnessed strong growth in sales in 2021 as well. Sales were up more than 200% in 2021 compared with 2020 as Esperion recorded growth in prescriptions every quarter last year.

The company recorded royalty revenues of $1.1 million during the first quarter of 2022, compared with $0.6 million in the year-ago quarter. Royalty revenues also improved from $0.8 million in the fourth quarter of 2021. Royalty revenues were driven by the continued rollout of Nilemdo and Nustendi in European countries as well as growth in previously launched territories.

The Zacks Consensus Estimate for total revenues for 2022 stands at $82.73 million, implying growth of 5.5% in 2022. Revenues are anticipated to more than double in 2023 from the estimated revenues in 2022.

The robust growth expectation for Esperion’s drugs have been attracting investors and driving its share price higher. The strong performance of Esperion’s drugs and stock is expected to continue in 2022.

Apart from the strong sales growth of its products, Esperion has also implemented cost-savings initiatives starting in October 2021 to boost its margins. The company is likely to have saved at least $20 million as part of the plan in 2021 and is expected to have another $80 million of savings in 2022. During the first quarter of 2022, the company achieved year-over-year cost savings of 32%, which led to the narrower year-over-year loss during the first quarter. The savings will help extend the company’s cash runway.

Esperion is currently evaluating bempedoic acid, a key ingredient of its drugs, for its effects on the occurrence of major cardiovascular events in patients with, or at high risk for, cardiovascular disease and are ineligible for the lowest approved statin dose. The company is expected to report top-line data from the cardiovascular outcomes study in the first quarter of 2023.

Positive data from the study is likely to boost the potential of Esperion’s drugs as the targeted patient population represents a lucrative opportunity.

Esperion Therapeutics, Inc. Price

Esperion Therapeutics, Inc. price | Esperion Therapeutics, Inc. Quote

Zacks Rank & Stocks to Consider

Esperion currently carries a Zacks Rank #3 (Hold).

Some better-ranked biotech/drug stocks are Alkermes ALKS, ProPhase Labs PRPH and Sesen Bio SESN. While ProPhase and Sesen Bio sport a Zacks Rank #1 (Strong Buy), Alkermes carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Alkermes’ 2022 loss per share has narrowed from 10 cents to 3 cents in the past 30 days. Shares of ALKS have risen 24% year to date.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.48%.

Earnings estimates for ProPhase’s 2022 bottom line have improved from earnings of 27 cents per share to 55 cents per share over the past 30 days. PRPH stock is up 23.8% this year so far.

ProPhase exceeded earnings expectations in two of the last four quarters, while missing the same twice. The company has a negative four-quarter earnings surprise of 130.56%, on average.

The Zacks Consensus Estimate for Sesen Bio’s 2022 loss has declined from 33 cents to 32 cents per share in the past 30 days. Shares of SESN have declined 38.1% in the year-to-date period.

Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 69.94%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alkermes plc (ALKS) : Free Stock Analysis Report

Esperion Therapeutics, Inc. (ESPR) : Free Stock Analysis Report

ProPhase Labs, Inc. (PRPH) : Free Stock Analysis Report

SESEN BIO, INC. (SESN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research