Esquire Financial Holdings' (NASDAQ:ESQ) Stock Price Has Reduced 24% In The Past Year

Esquire Financial Holdings, Inc. (NASDAQ:ESQ) shareholders should be happy to see the share price up 15% in the last month. But that doesn't change the fact that the returns over the last year have been less than pleasing. In fact the stock is down 24% in the last year, well below the market return.

See our latest analysis for Esquire Financial Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

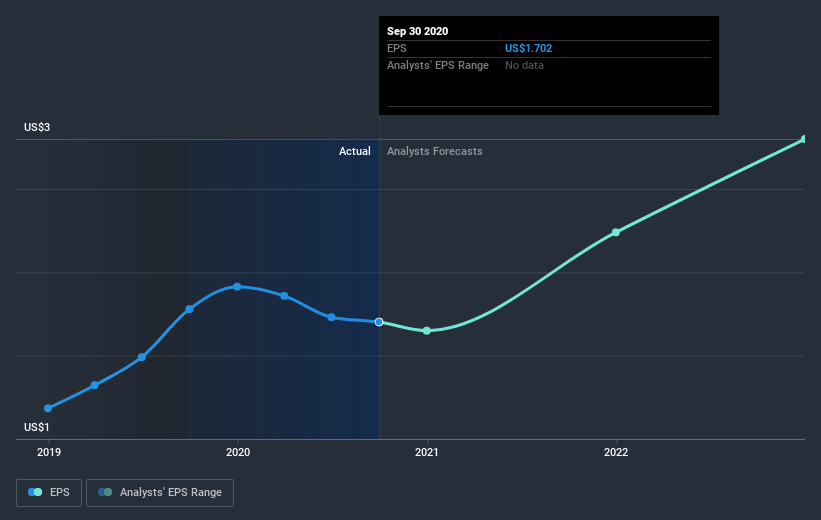

Unhappily, Esquire Financial Holdings had to report a 4.4% decline in EPS over the last year. This reduction in EPS is not as bad as the 24% share price fall. Unsurprisingly, given the lack of EPS growth, the market seems to be more cautious about the stock. The less favorable sentiment is reflected in its current P/E ratio of 10.75.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Esquire Financial Holdings' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Esquire Financial Holdings shareholders are down 24% for the year, but the broader market is up 24%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Shareholders have lost 1.0% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.