ETFdb Weekly Watchlist: TLT Awaits Fed Minutes; FXI, VGK Hinge On Manufacturing Data

Wall Street was in for yet another round of lackluster trading sessions last week, as investor concerns over a pullback and looming Fed taper fears weighed heavily on U.S. equities. In economic news, initial jobless claims fell for the week, while the Federal Reserve Bank of New York’s Empire State Manufacturing Survey showed a sharp improvement in labor conditions. Meanwhile bond markets across the globe saw yields skyrocket, pushing 10-year Treasury notes yields to levels not seen since 2011 [see also How To Take Profits And Cut Losses When Trading ETFs]:

1. China Large-Cap ETF (FXI, B)

Why FXI Will Be In Focus: This ETF measures the Chinese stock market with a large cap spin, making it one of the more popular emerging market funds. Its place in the spotlight will come on Wednesday as China’s HSBC Flash Manufacturing PMI data is released. In the previous recording, manufacturing PMI came in at 7.7 versus the expected 48.6. Analyst are expecting the metric to come in slightly higher at 48.3 (a reading below 50 indicates industry contraction). [see Single Country ETFs: Everything Investors Need To Know].

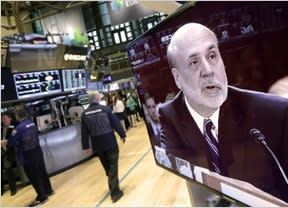

2. Barclays 20 Year Treasury Bond Fund (TLT, B)

Why TLT Will Be In Focus: This fund is designed to measure the performance of U.S. Treasury securities that have a remaining maturity of at least 20 years. TLT will come into focus on Wednesday as the FOMC minutes from the last meeting are released. While in his last commentary Bernanke announced that the central bank’s current bond-buying program will remain unchanged, investors will be looking for any hints of Fed tapering in the latest minutes.

3. FTSE Europe ETF (VGK, A+)

Why VGK Will Be In Focus: This ETF offers broad-based exposure to the developed economies of Europe, spreading holdings across more than a dozen markets. Its place in the spotlight will come on Thursday as French and German Flash Manufacturing PMI data are reported. Both metrics are expected to come in slightly higher from the previous recording [see also How To Pick The Right ETF Every Time].

Follow me on Twitter @DPylypczak.

Disclosure: No positions at time of writing.

Click here to read the original article on ETFdb.com.

Related Posts: