ETFs Embrace Fundamental and Alternative Indices

The oldest ETFs are pegged to indices that weight stocks by size or market capitalization in an effort to simply mirror the market. However, some ETFs are finding success and assets with benchmarks that weight companies by fundamental factors such as dividends or revenue.

“These funds tend to straddle the lines between passive and active management,” Paul Baiocchi, market researcher, said in a recent report. “It’s a type of market that can appeal to both types of investors.” [A Fundamentally-Weighted Index ETF That's Beating the Market]

Traditional market-cap weighted indices have a place in stock markets and investing, however, alternative indexing methods have been able to keep pace with the evolution of global markets and the complexity within them, according to one financial advisor.

Research Affiliates have been at the forefront of fundamental indexing, creating indices that select and weight stocks by measures such as profit, sales, or dividends. Market-cap weighting is the most traditional and common index profile, which ranks stocks strictly by market cap, or share price multiplied by the number of shares outstanding, reports Murray Coleman for The WSJ. [Rising Interest for Alternative Enhanced Index ETFs]

Market-cap weighting has been criticized because they tend to weight heavily toward overvalued stocks. Fundamental indexing breaks the mold as the number of resourceful, performing, broad-based indices is relatively small.

PowerShares has already broken ground with many fundamentally-weighted index tracking ETFs.

Charles Schwab has five fundamental index funds, using the methodology advanced by Rob Arnott, head of Research Affiliates, reports USA Today. Schwab has filed to launch fundamental index ETFs. [The Ins and Outs of an Equal-Weight ETF]

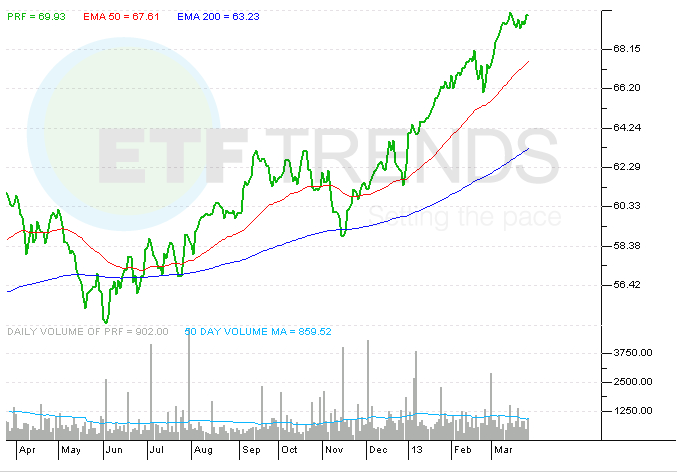

Fundamentally-weighted RAFI indices, for example, back the PowerShares FTSE RAFI 1000 Portfolio (PRF) which has gained $1.7 billion in assets.

“In a 2010 paper, Rob Arnott and Shane Shepherd of Research Affiliates, the promoters of fundamental indexation, showed that the FTSE RAFI Emerging Markets index had outperformed the capitalization-weighted FTSE Emerging Markets index by a huge nine percentage points per year between 1994 and 2009, without greatly increasing volatility,” Chris Heaton wrote for Index Universe.

Basically, it boils down to investors knowing what their ETF is holding. “Investors should know what’s inside their portfolio and how holdings are weighted,” Todd Rosenbluth of S&P Capital, said in Financial Advisor Magazine. “What has happened with Apple is a perfect example of the differences in indexes.”

Tisha Guerrero contributed to this article.

Story updated to correct Schwab fundamental index funds and ETF filings.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.