Ethereum Reaches a Staking Milestone

Over 9 million ETH are now deposited in the Ethereum 2.0 deposit contract. At today’s price, that is nearly $30 billion in capital looking to secure the proof-of-stake network and gain further exposure to Ethereum’s native asset.

This article originally appeared in Valid Points, CoinDesk’s weekly newsletter breaking down Ethereum 2.0 and its sweeping impact on crypto markets. Subscribe to Valid Points here.

However, those 9 million staked ETH really represent 280,000 active validators providing security, building blocks and ensuring the health of the network. It’s a number that seemingly grows around 1% each week and continues to further decentralize the network.

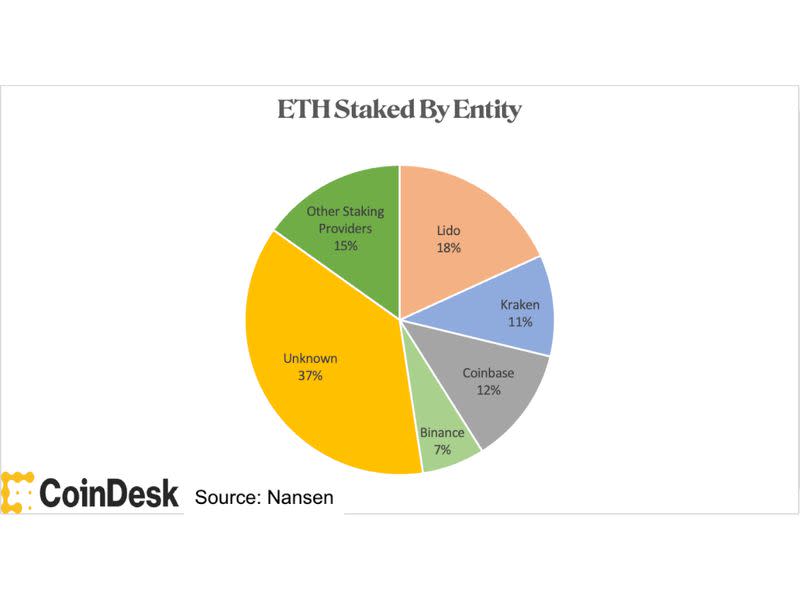

During August of last year, we wrote about which exchanges, staking pools and other entities were most responsible for a significant portion of validators and noted the top four staking entities on the Beacon Chain made up 36.6% of the total deposits. On Jan. 11, Nansen data shows Coinbase made its way into the list. The top four now cumulatively account for 47.5% of the staking contract, with Lido making a significant jump.

On the surface it appears that significant concentration near the top would affect the decentralization of the network. However, the rise of Lido (a decentralized and liquid alternative to staking pools) looks to be positive for the network. Staking providers give those with less than 32 ETH (over $100,000) an opportunity to earn yield through validation.

Over time, decentralized staking providers like Lido and RocketPool have closely aligned with the health of Ethereum, allowing the respective protocols to choose a variety of node operators that run different clients and diversify concentration risk.

Welcome to another issue of Valid Points.

Pulse check

The following is an overview of network activity on the Ethereum 2.0 Beacon Chain over the past week. For more information about the metrics featured in this section, check out our 101 explainer on Eth 2.0 metrics.

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking venture will be donated to a charity of the company’s choosing once transfers are enabled on the network.

Validated takes

Ethereum’s new proof-of-stake test network, Kintsugi, faced a chain split on Friday. BACKGROUND: Hyperledger’s Besu suffered client-related issues that led to the creation of bad blocks and a three-way chain split. The bug in Kintsugi highlights the need for test networks, as the Beacon Chain will be made more resilient without any funds needing to be at risk.

Mining giant Hive Blockchain announced it held all of its mined bitcoin and most of its mined ether during 2021. BACKGROUND: As crypto has gone mainstream and large mining organizations receive further outside capital, they lose the need to cover expenses and ongoing operations. Outside funding helps miners better align with the crypto ecosystem and bet on the future of the assets they earn for validating the network.

Over 18,000 ETH were burnt via transaction fees in a 24-hour period between Sunday and Monday. BACKGROUND: The rush for blockspace was likely due to OpenSea volume hitting new highs while crypto asset prices simultaneously dumped. For a full day, ether was deflationary and the supply was reduced by over 4,000 ETH.

On-chain users flock to Fantom as Andre Cronje and Daniele Sestagalli are set to release a new decentralized exchange. BACKGROUND: Renowned DeFi developers Cronje and Sestagalli, known for founding Yearn and Abracadabra, respectively, are collaborating on a new project on Fantom. The duo announced the project would be a decentralized exchange optimized for protocol usage. Dubbed ve(3,3), the new protocol will implement tokenomics stemming from both Curve and Olympus DAO, driving hype to the project.

Factoid of the week

Open comms

Valid Points incorporates information and data about CoinDesk’s own Eth 2.0 validator in weekly analysis. All profits made from this staking venture will be donated to a charity of our choosing once transfers are enabled on the network. For a full overview of the project, check out our announcement post.

You can verify the activity of the CoinDesk Eth 2.0 validator in real time through our public validator key, which is:

0xad7fef3b2350d220de3ae360c70d7f488926b6117e5f785a8995487c46d323ddad0f574fdcc50eeefec34ed9d2039ecb.

Search for it on any Eth 2.0 block explorer site.