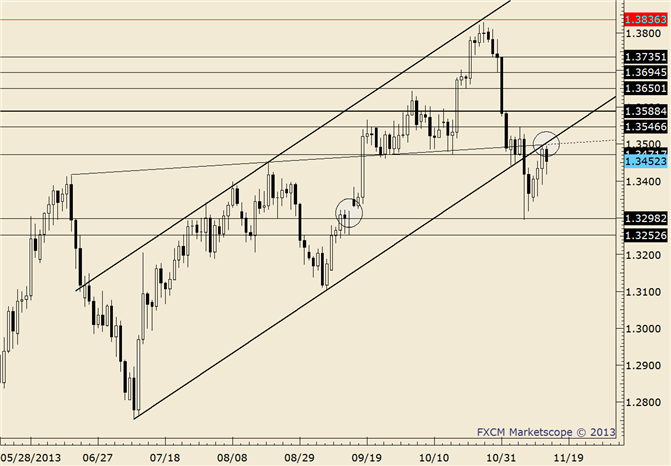

EUR/USD

EUR/USD Near Term Flat Pattern May Offer Short Soon

Hourly

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

Interested in automated trading with Mirror Trader?

FOREXAnalysis: Keep high volume areas of 1.3242 and 1.3294 (post FOMC close) in mind but don’t lose sight of the fact that 1.3200 held for 3 days and has produced important tops in recent months (April high and 5/8 high). Near term, it’s possible that a flat correction is underway from the 7/11 low. The implications are for price to trade above 1.3121 before declining sharply. Resistance extends to 1.3175.

FOREX Trading Strategy: Wrote last week that “estimated resistance before the high is 1.3160 to 1.3180. In these market conditions the closest level to sell against is the June high (1.3415) though. Prefer to see what happens Friday.” There is enough evidence now to sell into 1.3145 with a stop above 1.3205.

LEVELS: 1.2887 1.2947 1.3003 1.3121 1.31461.3175

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.