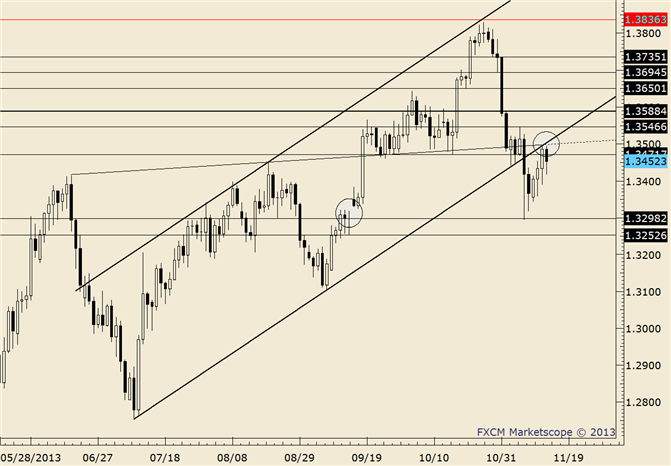

EUR/USD

EUR/USD-Will Trendline Come into Play on FOMC?

Daily

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

FOREXAnalysis: Price closed right at the 2/7 close (large volume) at 1.3396. A cluster of levels are overhead; the 2/20 high at 1.3433, the trendline that extends off of the 2011 and 2013 highs at 1.3447 tomorrow), and the 2/5 low at 1.3458. As it stands, the market could be setting up for a spike into the high on FOMC before reversing. The rally from the 6/10 low is accompanied by pathetic momentum and a measured objective from the 1.3305-1.3177 range is 1.3433.

FOREX Trading Strategy: Recent comments were to “watch with USDCHF. A new high in EURUSD that is not confirmed by a new USDCHF low would be a ‘tell.’” This happened today so it’s possible that a high is in place but stand in front of FOMC I shall not. There is sure to be a bunch of nonsense psychobabble tomorrow but I’m looking for a top between 1.3433 and 1.3458. Any updates will be released via Twitter @JamieSaettele.

LEVELS: 1.3177 1.3245 1.3305 1.3433 1.34581.3485

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.