EUR/USD Daily Forecast – Euro Resumes Higher After a Brief Dip

Fed Minutes Confirm Policymakers on Hold

The biggest take away from yesterday’s Fed meeting was that policymakers are happy with monetary policy the way it stands and see no reason to act in the near-term. This is in line with what the view was after the actual meeting, and as such, there was a minimal reaction in the market.

It’s quite likely that the Fed will want to see how things play out with the US-China trade war. Risk assets have gained as of late on the expectations that ‘phase 1’ of a deal will be reached soon. However, most of these assets are seen paring back some gains this week as optimism has faltered somewhat.

Nevertheless, with the potential of a deal still out there, I would expect the Fed to stand pat for now. But if trade talks start to veer off course, I do think the markets will once again start exploring the possibility of more easing. Further, incoming data will be important. Especially with fears of an economic slowdown abating as the last few recent data releases have been quite positive.

Technical Analysis

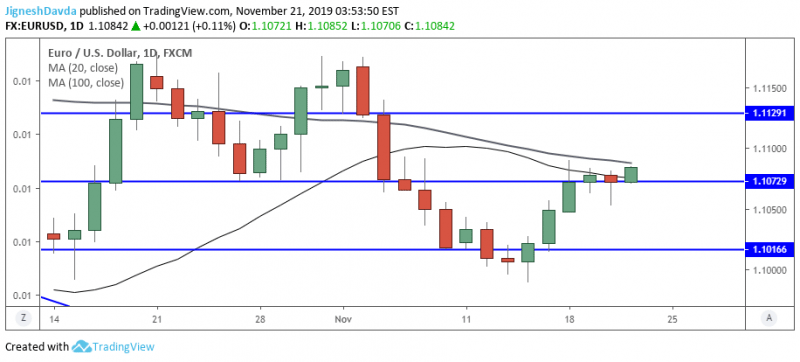

The price action over the week has been interesting and I think it paints a picture of where EUR/USD prices want to go.

For most of the week, the pair has been range bound in a roughly 20 pip range between 1.1063 and 1.1083. Yesterday, we saw some downside pressure which led to a bearish range break.

We’ve recovered the losses and the pair is on pace to print a fresh two-week high. Looking back at this price action, it looks as if the earlier downward move was a bear trap and that the pair is ready to resume higher.

There is still a fair amount of resistance in play, and I think this should not be ignored. The 20-day moving average is still in play even though EUR/USD prices is currently above it. The 100-day moving average is also within reach. For these reasons, the daily close today will be important.

What is offering a bullish signal here is yesterday’s daily close above 1.1072 despite trading below it for a bulk of the day. In the dollar index (DXY), yesterday’s price action resulted in a doji which is a more prominent signal.

The conservative play might be to wait for a break above the 100-day moving average, for confirmation, and then look to get involved on a pullback.

Bottom Line

EUR/USD is breaking upward from a prior range after a fake breakdown.

The dollar index (DXY) printed a doji yesterday to suggests the downtrend might have resumed.

This article was originally posted on FX Empire