EUR/USD Daily Forecast – Euro Eyeing 1.1400 Handle

EUR/USD Upside Momentum Hints of a Major Trend Shift

Perhaps it is unusual to see so much momentum in EUR/USD into the summer months but the pair seems to be showing signs of a large reversal.

Looking at the price action from late last year, the pair had essentially consolidated in tight ranges. This can be best seen on a weekly chart. But it is not just price action, the fundamental backdrop has changed.

Last week the Federal Reserve gave the signal their next move is likely to be a cut rather than a hike. I consider this to be a really big shift. Prior to this, the bank had been raising rates for several years, without any discussions of easing policy whatsoever.

While the Fed only signaled about 30 basis points in 2020, the markets seem to think the bank will not only move sooner but will cut much more than 30 basis points. The reaction in the dollar seems to support this view as well.

I think EUR/USD will be a lot more sensitive to incoming US data and any further weakness will give bears a reason to sell dollars. This could potentially be the start of a big move for the currency pair.

Technical Analysis

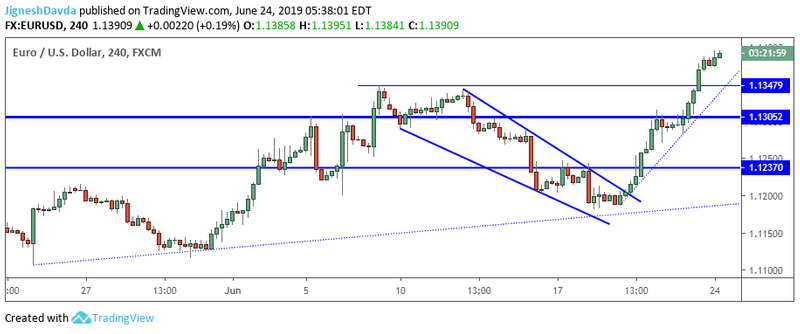

On the higher time frames, a horizontal level at 1.1457 seems to be important and that is the area I’m projecting EUR/USD will go to next. The pair has not done much in early trading, and a light economic calendar today might ensure it remains that way for the rest of the day.

The support level I’m watching is at 1.1347. This marks the high posted in the first week of the month. There is also some confluence from a rising trendline.

I do see further support at 1.1305 but I think EUR/USD might not get there. To maintain the upside momentum from last week, I expect that any near-term dips will be bought in the pair. Currently, I don’t see a reason for the pair to pull back that far.

Bottom Line

I expect EUR/USD will target 1.1457 after it scales above 1.1400.

Near-term support at 1.1347 stands to keep the pair supported

The calendar is light today, but US Consumer confidence, as well as some Fed speeches, are scheduled for tomorrow.

This article was originally posted on FX Empire