EUR/USD Fundamental Analysis – week of March 19, 2018

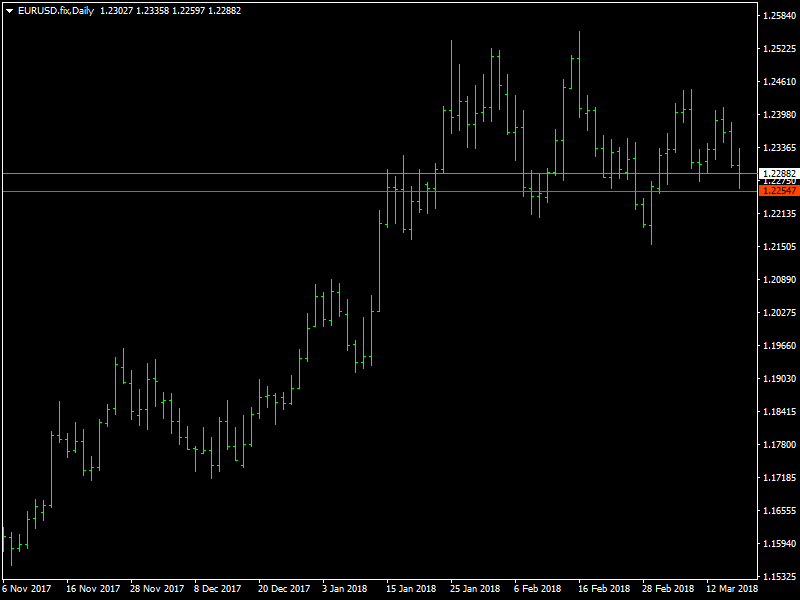

The EURUSD ended the week back near the lows of its range as the dollar gained in strength slowly and steadily during the course of the week. It did not appear so at the beginning of the week as the dollar was affected by the weak growth in the average wages and this helped the euro to move through the 1.24 region. The incoming data during the course of the week from the US was choppy at best and it did little to help the dollar.

EURUSD Near Support

But towards the end of the week, we saw some growing anticipation over the meeting of the FOMC next week and this helped to give a boost to the dollar. The Fed is expected to hike rates during the meeting in March and also lay out a timeline for the future rate hikes during the course of the year. The market expects the Fed to hike the rates 4 times this year and hence the traders would be looking out for hints and signals regarding the same. This pushed the euro lower and the pair ended the week near a support region and it remains to be seen whether we would see a break of that in the coming week.

But the dollar bulls have to remember that they are not out of the woods as yet. The expectation of a bullish dollar and strong incoming data has been built up so much over the last few weeks that even that data which comes in as expected during this period has been viewed as a failure and a blow to future rate hikes from the Fed. Such overblown expectations generally end in tears and we have to wait and see what happens now.

The coming week is likely to be highly volatile with the G20 meetings also scheduled to be held in the first part of the week and the FOMC rate decision and press conference scheduled for the later part of the week. It will be the first FOMC related press conference that the new Fed Chief Powell would be handling and the market would also be eager to know what he thinks about the state of the economy and the monetary policy.

This article was originally posted on FX Empire

More From FXEMPIRE:

GBP/JPY Price forecast for the week of March 19, 2018, Technical Analysis

GBP/USD Price forecast for the week of March 19, 2018, Technical Analysis

S&P 500 Price forecast for the week of March 19, 2018, Technical Analysis

USD/JPY Price forecast for the week of March 19, 2018, Technical Analysis

EUR/GBP Price forecast for the week of March 19, 2018, Technical Analysis

Silver Price forecast for the week of March 19, 2018, Technical Analysis