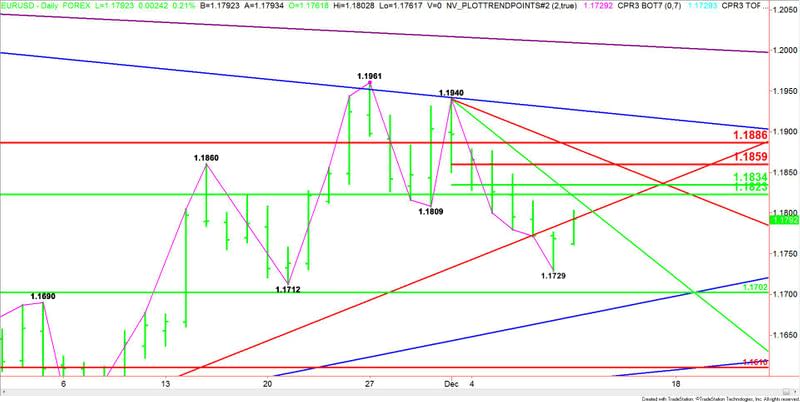

EUR/USD Mid-Session Technical Analysis for December 11, 2017

The EUR/USD is trading higher shortly after the U.S. opening. Position-squaring ahead of Wednesday’s Fed interest rate decision may be behind the move.

Daily Technical Analysis

The main trend is down according to the daily swing chart. A trade through 1.1729 will signal a resumption of the downtrend. This could fuel a further break into the next main bottom at 1.1712.

On the downside, the first major target is a long-term 50% level at 1.1702. The next major target is a long-term Fibonacci level at 1.1610.

On the upside, the first major target is a long-term 50% level at 1.1823.

The short-term range is 1.1940 to 1.1729. Its retracement zone at 1.1834 to 1.1859 is another target area. This is followed by a major Fibonacci level at 1.1886.

The EUR/USD is going to have a hard time driving through this series of potential resistance levels.

Daily Technical Forecast

Based on the early trade, the direction of the EUR/USD is likely to be determined by trader reaction to the uptrending Gann angle at 1.1793.

A sustained move over 1.1793 will indicate the presence of buyers. This could lead to a labored rally with potential resistance at 1.1820, 1.1823 and 1.1834. Since the main trend is down, sellers could show up at any of these levels.

Taking out 1.1834 could trigger a surge into 1.1859.

The inability to overcome 1.1793 will signal the presence of buyers. This could lead to a retest of 1.1729, followed by 1.1712 and 1.1702.

Watch the price action and read the order flow at 1.1793 all session. Trader reaction to this angle will tell us if the buyers are retaking control.

This article was originally posted on FX Empire