Euro Motionless Despite Dovish ECB and Bullish US Data - What Gives?

Please add a description for the image.

Euro Motionless Despite Dovish ECB and Bullish US Data - What Gives?

Fundamental Forecast for Euro: Bearish

Euro tumbmes as European Central Bank contemplates negative rates

US Nonfarm Payrolls initially sends US Dollar surging, but Euro recovers losses

Technical Forecasts for Euro and Swiss Franc warn of key turning point

There are a number of reasons for why the Euro should have finished the week lower against the US Dollar, but the single currency’s resilience in the face of interest rate cuts and strong US data suggests traders aren’t ready to force it to fresh lows.

It initially seemed as though a European Central Bank interest rate cut and the threat of further easing from the ECB would be enough to sink the EURUSD, but traders had other things in mind and forced a substantive Thursday reversal. Then it was a strongly better-than-expected US Nonfarm Payrolls report that sent the EURUSD reeling to fresh month-to-date lows. But even a surge in US interest rate expectations couldn’t keep the Greenback at fresh peaks against the resilient Euro.

If bearish surprises out of Europe and bullish developments out of the US couldn’t force the Euro out of its trading range—what will? A relatively empty economic calendar in the days ahead offers little hope of a major breakout in either direction for the EURUSD, and indeed FX options traders are paying the lowest prices for Euro volatility since January.

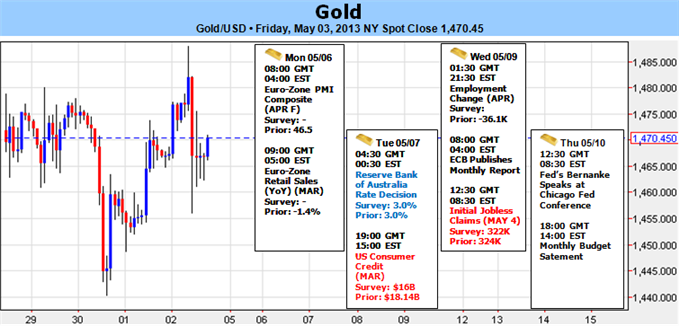

Early-week European Purchasing Managers Index data represents arguably the only concrete bit of mid-tier economic event risk out of the Euro Zone for the week ahead as clearly disappointing Flash PMI figures forced an important Euro sell-off on April, 23. But consensus estimates predict that overall figures remained unchanged, and important revisions seem unlikely.

A smattering of scheduled speeches from ‘Troika’ officials could otherwise drive short-term moves in EUR pairs, while an end-of-week meeting of G8 Finance Ministers could spark broader FX market volatility if we hear commentary on the Japanese Yen. No one really expects any of these events to force the Euro out of its range, but why didn’t recent developments force a breakout or breakdown?

On the one hand, the recent ECB rate cut and threat of negative benchmarkinterest rates should be of real concern to Euro traders. On the other, tail risks in the Euro Zone (e.g. a Cypriot exit) have subsided and have clearly helped the Euro recover from April lows. In fact, Euro Zone periphery bond prices surged and yields tumbled to significant lows through Friday’s close.

The US Dollar isn’t exactly the model of a healthy currency, either; the FOMC spooked USD traders as it said it could decrease OR increase the level of Quantitative Easing measures through its recent rate decision. Yet US economic developments offer reasons to be optimistic, and recent labor market data shows that unemployment continued its declines for all of the “right” reasons. Employment gains should keep the Fed at bay through the foreseeable future, and in fact Eurodollar (interest rate) futures showed the biggest single-day improvement in yield expectations since January, 25. At that point the surge in yields was enough to push the Dollar to its largest single-day gain in 7 months. This time around? The Dow Jones FXCM Dollar Index finished the day lower.

It’s important to put things into context—that January surge in US yield expectations came within a trend of higher interest rate forecasts. This time it’s the opposite, and today’s improvement comes after Fed interest rate forecasts were essentially at record-lows. The sharp correction on Friday could have plausibly been profit-taking on prior bets, and it’s not clear whether this is truly the start of a significant turn.

Markets are left wondering whether either Europe or the US will give traders a reason to force a more sustained EURUSD breakout. As things stand, the Euro looks likely to stick to its recent trading range against the similarly directionless US currency. – DR

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.