Euro Slides Across the Board as ECB Unveils Unlimited Sterilized Program

THE TAKEAWAY: EUR European Central Bank Press Conference > New unlimited sterilized bond-buying program announced > EURUSD BEARISH

The European Central Bank surprised the market today by keeping rates on hold at 0.75%, whereas the consensus forecast provided by Bloomberg News suggested the main refinancing rate would be cut to 0.50%. However, investors took this as good news, with the likely outcome that the ECB was readying to unveil a major bond-buying program to help soothe volatility in peripheral European bond markets.

However, to say that market participants got their desired outcome is a bit of a reach. Indeed, the ECB introduced a new program to replace the securities market program (SMP), called “Outright Monetary Transactions” (OMTs). President Mario Draghi issued justification for the measures, saying the ECB needs “we need to be in the position to safeguard the monetary policy transmission mechanism in all countries of the euro area… OMTs will enable us to address severe distortions in government bond markets which originate from, in particular, unfounded fears on the part of investors of the reversibility of the euro.”

If there were any questions on the legality of these measures, President Draghi made the case that the OMTs would be very much allowed. “Under appropriate conditions, we will have a fully effective backstop to avoid destructive scenarios with potentially severe challenges for price stability in the euro area. Let me repeat what I said last month: we act strictly within our mandate to maintain price stability over the medium term; we act independently in determining monetary policy; and the euro is irreversible.”

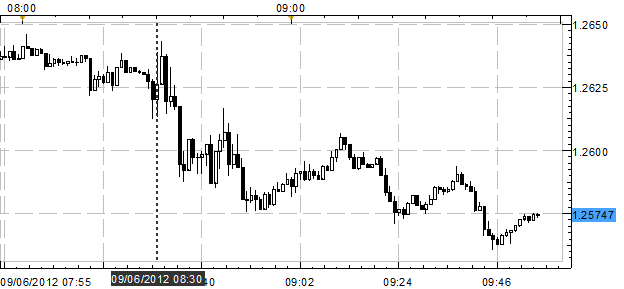

EURUSD 1-minute Chart: September 6, 2012

Charts Created using Marketscope – Prepared by Christopher Vecchio

Nevertheless, despite these new measures, which can be summed up as an unlimited sterilized bond-buying program (just like the SMP that preceded it), the Euro began sliding across the board, with no specific yield caps in place. The sterilization likely means that the ECB will have to sell an equivalent amount of core debt (mainly German) in order to finance the purchases of Italian and Spanish debt; the necessary question is: how long will this last for?

The EURUSD slid from its former yearly low at 1.2626 (set in January and maintained until May) to as low as 1.2561 following the press conference, before rebounding back to 1.2575, at the time this report was written. Similar price action was observed across other Euro-crosses, with the EURAUD moving from 1.2360 at the time of the rate announcement to as low as 1.2272. The EURGBP dropped from 0.7950 to as low as 0.7906, before rebounding to 0.7910 at the time of writing.

Presented below without commentary are excerpts from President Draghi’s press conference:

On the Euro-zone’s economics:

Recently published statistics indicate that euro area real GDP contracted by 0.2%, quarter on quarter, in the second quarter of 2012, following zero growth in the previous quarter.

Looking beyond the short term, we expect the euro area economy to recover only very gradually. The growth momentum is expected to remain dampened by the necessary process of balance sheet adjustment in the financial and non-financial sectors, the existence of high unemployment and an uneven global recovery.

The September 2012 ECB staff macroeconomic projections for the euro area foresee annual real GDP growth in a range between -0.6% and -0.2% for 2012 and between -0.4% and 1.4% for 2013.

Compared with the June 2012 Eurosystem staff macroeconomic projections, the ranges for 2012 and 2013 have been revised downwards.

The risks surrounding the economic outlook for the euro area are assessed to be on the downside.

Euro area annual HICP inflation was 2.6% in August 2012, according to Eurostat’s flash estimate, compared with 2.4% in the previous month. This increase is mainly due to renewed increases in euro-denominated energy prices.

On the basis of current futures prices for oil, inflation rates could turn out somewhat higher than expected a few months ago, but they should decline to below 2% again in the course of next year.

Over the policy-relevant horizon, in an environment of modest growth in the euro area and well-anchored long-term inflation expectations, underlying price pressures should remain moderate.

The September 2012 ECB staff macroeconomic projections for the euro area foresee annual HICP inflation in a range between 2.4% and 2.6% for 2012 and between 1.3% and 2.5% for 2013. These projection ranges are somewhat higher than those contained in the June 2012 Eurosystem staff macroeconomic projections.

Risks to the outlook for price developments continue to be broadly balanced over the medium term.

Upside risks pertain to further increases in indirect taxes owing to the need for fiscal consolidation.

The main downside risks relate to the impact of weaker than expected growth in the euro area, particularly resulting from a further intensification of financial market tensions, and its effects on the domestic components of inflation. If not contained by effective action by all euro area policy-makers, such intensification has the potential to affect the balance of risks on the downside.

On the Euro-zone’s monetary conditions:

The underlying pace of monetary expansion remained subdued. The annual growth rate of M3 increased to 3.8% in July 2012, up from 3.2% in June.

The rise in M3 growth was mainly attributable to a higher preference for liquidity, as reflected in the further increase in the annual growth rate of the narrow monetary aggregate M1 to 4.5% in July, from 3.5% in June.

The annual growth rate of loans to the private sector (adjusted for loan sales and securitization) remained weak at 0.5% in July (after 0.3% in June). Annual growth in MFI loans to both non-financial corporations and households remained subdued, at -0.2% and 1.1% respectively (both adjusted for loan sales and securitization).

To a large extent, subdued loan growth reflects a weak outlook for GDP, heightened risk aversion and the ongoing adjustment in the balance sheets of households and enterprises, all of which weigh on credit demand. Furthermore, in a number of euro area countries, the segmentation of financial markets and capital constraints for banks continue to weigh on credit supply.

Looking ahead, it is essential for banks to continue to strengthen their resilience where this is needed. The soundness of banks’ balance sheets will be a key factor in facilitating both an appropriate provision of credit to the economy and the normalization of all funding channels.

To sum up, the economic analysis indicates that price developments should remain in line with price stability over the medium term. Across-checkwith the signals from the monetary analysis confirms this picture

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, send an e-mail with subject line "Distribution List" to cvecchio@dailyfx.com

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.