Euronet's (EEFT) Q4 Earnings Miss Estimates, Increase Y/Y

Euronet Worldwide, Inc. EEFT reported adjusted earnings of $1.15 per share for fourth-quarter 2021, missing the Zacks Consensus Estimate of $1.33 by 13.5% due to steep expenses. The bottom line improved 4% year over year.

EEFT reported a net loss of 6 cents per share for the fourth quarter against the prior-year quarter’s net income of $1.31.

Total revenues improved 15% year over year to $811.5 million in the quarter under review. Further, the top line outpaced the Zacks Consensus Estimate by 0.6%.

EEFT gained from double-digit consolidated revenues and adjusted EBITDA growth rates. Euronet also gained from EFT processing, epay and Money Transfer segmental performances.

In the fourth quarter, operating income amounted to $29 million, which decreased 42% year over year.

Total operating expenses increased 19.2% year over year to $782.5 million due to a rise in direct operating costs, salaries and benefits, and contract asset impairment as well as selling, general and administrative expenses.

Adjusted EBITDA was up 23% year over year to $112.9 million.

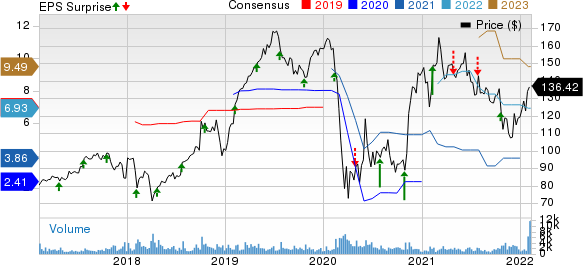

Euronet Worldwide, Inc. Price, Consensus and EPS Surprise

Euronet Worldwide, Inc. price-consensus-eps-surprise-chart | Euronet Worldwide, Inc. Quote

Segmental Results

The EFT Processing Segment’s total revenues of $163.5 million surged 63% (up 68% on a constant currency basis) year over year owing to higher domestic and international withdrawal transactions, resulting from partial lifting of travel restrictions in Europe. Other factors contributing to the upside include volume expansion of low-value point-of-sale transactions in Europe and low-value payment processing transactions from an Asia Pacific customer.

Adjusted EBITDA came in at $25.9 million during the quarter, which compared favorably with the prior-year quarter’s figure of $1 million.

Operating income of $1.8 million compared favorably with the year-ago quarter’s operating loss of $21.2 million. This segment’s total transactions of 1279 million rose 42% year over year in the fourth quarter.

The epay Segment’s total revenues of $286.9 million rose 4% year over year (up 7% on constant currency basis).

Adjusted EBITDA totaled $42.6 million, which inched up 1% year over year (up 5% on constant currency basis).

Operating income amounted to $40.6 million, reflecting a year-over-year ascent of 2% (up 7% on constant currency basis). Reported transactions advanced 21% year over year to 854 million in the quarter. The results are attributable to customer growth across digital media and mobile growth along with continued expansion of the digital distribution channel. Other factors leading to solid fourth-quarter results are decreased mobile operator commissions.

The Money Transfer Segment’s total revenues of $363.3 million rose 10% year over year (up 11% on constant currency basis) in the quarter. The upside can be attributed to an uptick in the U.S. and international-outbound transactions, excluding the Middle East and Asia as well as growth in the direct-to-consumer digital transactions. The same was partly offset by a dip in Asia and the Middle East transactions and declines in the U.S. domestic business.

Adjusted EBITDA was $50.1 million in the quarter under review, which decreased 8% year over year (down 5% on constant currency basis). Operating income totaled $2.7 million, which compared unfavorably with the year-ago quarter’s reported figure of $45 million. This segment’s total transactions rose 10% year over year to 35.7 million in the fourth quarter.

Corporate and Other reported an expense of $16.1 million for the quarter, which increased 19.3% year over year, primarily due to a rise in long-term compensation expense.

Financial Update

As of Dec 31, 2021, total assets summed $4.74 billion, which plunged 3.7% from the level at 2020 end.

Cash and cash equivalents of $1.26 billion at the end of the fourth quarter fell 11.3% from the level at 2020 end.

Debt obligations, net of current portion, slipped 1.2% from the level as of Dec 31, 2020 to $1.4 billion at the end of 2021. At the end of the year, $690 million was available under its revolving credit facilities.

2021 Update

Full-year EPS came in at $3.69 per share, up 31% year over year. Revenues for the year rose 21% year over year (18% at CC).

Adjusted operating income for EEFT rose 45% year over year. Adjusted EBITDA increased 31% from the prior-year quarter’s level.

Zacks Rank

Euronet currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Finance Sector Releases

Of the finance sector players that have reported fourth-quarter results so far, the bottom-line results of American Express Company AXP, Synchrony Financial SYF and Discover Financial Services DFS beat the respective Zacks Consensus Estimate.

American Express' Q4 results gain from record card spending.

AXP reported fourth-quarter 2021 earnings of $2.18 per share, which beat the Zacks Consensus Estimate of $1.78. Also, the bottom line increased 24% year over year. AXP’s total revenues, net of interest expense, increased 30% year over year to $12,145 million. The top line beat the Zacks Consensus Estimate of $11,597 million.

Synchrony Financial reported fourth-quarter 2021 earnings per share of $1.48, which surpassed the Zacks Consensus Estimate of $1.47 by 0.7%. The bottom line improved around 19% year over year. SYF’s results benefited from solid growth in new accounts and a higher purchase volume. However, the same was offset to some extent by steep expenses.

Discover Financial reported fourth-quarter 2021 adjusted earnings of $3.64 per share, which outpaced the Zacks Consensus Estimate of $3.61. The bottom line also improved 41% year over year.

Discover Financial’s revenues — net of interest expenses — inched up 4% year over year to $2,936 million. Yet, the top line missed the Zacks Consensus Estimate of $2,997 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Discover Financial Services (DFS) : Free Stock Analysis Report

American Express Company (AXP) : Free Stock Analysis Report

Euronet Worldwide, Inc. (EEFT) : Free Stock Analysis Report

Synchrony Financial (SYF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research