EV Roundup: F's $7B Investment, TSLA's Q3 Deliveries, GM's EV410 Reveal & More

With the electric vehicle (EV) revolution gathering pace with each passing day, legacy automakers are stepping up e-mobility investments and setting ambitious targets to electrify their fleet. Pure-play EV players are fast filing IPOs to capitalize on the rising electrification trends.

Last week, Sweden-based EV maker Polestar announced plans to go public via a merger with a special purpose acquisition company (SPAC), Gores Guggenheim, at an enterprise valuation of around $20 billion. The SPAC deal will provide Polestar with cash proceeds of more than $1 billion, which would help the company roll out three new models in the market in the next three years. EV startup Rivian, which commenced deliveries of its R1T truck last month — released its IPO filing on Friday. What caught the most attention was the fact that the company is burning cash and reeling under losses. It incurred a net loss of $994 million in first-half 2021 versus $377 million in the corresponding period of 2020.

Meanwhile, EV behemoth Tesla TSLA released its delivery count for the third quarter of 2021. During the three months ended Sep 30, the company delivered 241,300 vehicles (comprising 232,025 Model 3/Y and 9,275 Model S/X). Tesla currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

China-based EV players including NIO Inc. NIO, XPeng XPEV and Li Auto LI also provided September and third-quarter 2021 delivery updates. NIO’s third-quarter deliveries grew 100.2% year over year to 24,439 vehicles. Sales for the month of September increased 125.7% to 10,628 units (comprising 1,978 ES8s, 5,260 ES6s and 3,390 EC6s). XPeng witnessed record deliveries of 25,666 units in the third quarter, skyrocketing 199% year over year. The company delivered 10,412 Smart EVs for the month of September. Li Auto delivered 25,116 vehicles during the quarter, reflecting a surge of 190% year over year. In September, 7,094 Li ONEs were delivered, up 102.5% year over year.

Recap of the Week’s Most Important Stories

1. Ford F announced plans of building two new environment-friendly and technologically advanced campuses in Tennessee and Kentucky that will produce the next generation of electric F-Series trucks as well as batteries to power the future electric Ford and Lincoln vehicles. The U.S. auto giant will partner with SK Innovation, and the firms will together invest $11.4 billion (with Ford’s share being $7 billion) for the same. Roughly $5.6 billion of the investment will be used for building an all-new mega campus called Blue Oval City in Stanton. Another $5.8 billion will be allocated toward the development of a 1,500-acre BlueOvalSK battery manufacturing campus in Glendale. (Ford to Transform EV Future in U.S. Via $11.4B Investment)

2. General Motors’ GM commercial EV business — BrightDrop — announced plans to add a second van, the EV410, to its vehicle line-up in 2023. Verizon Communications, one of the largest fleet operators in the United States, is scheduled to be the first customer of the EV410. Apart from this, BrightDrop also announced the completion of the first production builds of the EV600. The EV600, unveiled this January, is BrightDrop’s first all-electric light commercial delivery van equipped with General Motors' next-generation Ultium battery system, having an estimated range of up to 250 miles on a full charge. (General Motors' BrightDrop Unveils EV410, Completes EV600 Build)

The U.S. auto biggie also announced plans to power all its U.S. sites with 100% renewable energy by 2025 — five years earlier than previously announced and 25 years ahead of its initial target of 2050 that was set in 2016. With this move, General Motors aims to evade 1 million metric tons of carbon emissions that would have been otherwise produced between 2025 and 2030. (General Motors to Procure 100% Renewable Energy in US by 2025).

In another development, General Motors unveiled Ultifi, a new end-to-end software platform in vehicles starting from 2023, built to unleash new vehicle experiences and seamlessly integrate customers’ digital lives.

3. Lordstown RIDE announced that it has inked an agreement with Foxconn to work together on scalable EV programs. Per the deal, Foxconn would buy the Lordstown assembly plant in northeast Ohio for $230 million and manufacture the latter’s first product, an all-electric full-size pick-up truck called the Endurance. The partnership will open up greater market opportunities for both Lordstown and Foxconn to rev up EV production in North America. Lordstown also issued an update on its 2021 financial guidance. While the capex estimate remains unchanged in the $375-$400 million band, SG&A expenditures are now projected at $105-$120 million, up from $95-$105 million expected earlier. R&D expenditures are now forecast within $320-$340 million, up from the previous projection of $310-$320 million. (Lordstown Gets a Breather With Foxconn Deal, Tweaks ’21 View)

4. Nikola Corporation NKLA announced a second $300-million capital raise deal with Tumim Stone Capital, providing the former the right to issue and sell to Tumim up to $600 million of Nikola's common stock in aggregate. Per the second equity line purchase agreement, Nikola has the right but not the obligation to sell up to $300 million of additional shares of its common stock to Tumim, subject to certain limitations. The shares will be issued at a 3% discount to the three-day forward volume-weighted average price from the date a purchase notice is issued. The second equity line purchase agreement is a financing tool that allows Nikola to enhance its liquidity while giving considerable flexibility as the company ramps up production milestones next year. (Nikola Inks 2nd Deal With Tumim to Sell Up to $300M Stock).

In another development, Nikola inked a deal with OPAL Fuels to jointly establish hydrogen fueling stations and related infrastructure to rev up the adoption of heavy-duty emission-free fuel-cell EVs.

5. Allison Transmission Holdings ALSN announced that its next-generation electric hybrid propulsion solution, eGen Flex, will be offered by New Flyer Industries Canada ULC and New Flyer of America Inc. in early 2022. The eGen Flex system has the capacity of a full electric drive for up to 10 miles and can do away with engine emissions, and noise generated at the time of boarding and de-boarding of passengers in congested areas as well as in zero-emission demarcated zones, thus ensuring a calm surrounding. (Allison's eGen Flex to be Offered by New Flyer in 2022).

In a separate news, Allison also entered into a memorandum of understanding with SAIC Hongyan, per which, it will deploy its eGen Power 130D e-Axle into the China-based automaker’s regional and long-haul tractors.

Price Performance

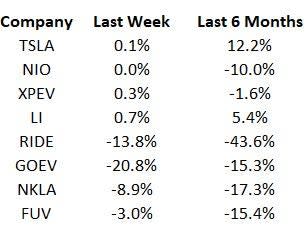

The following table shows the price movement of some of the major EV players over the past week and six-month period.

Image Source: Zacks Investment Research

In the past six months, all stocks have decreased, apart from Li Auto. Lordstown Motors bore the maximum brunt, with shares declining 43.6%. In the past week, Lordstown, Canoo, Nikola and Arcimoto lost value, with Canoo being the worst performer.

What’s Next in the Space?

Stay tuned for announcements of upcoming EV models and any important updates from the red-hot industry. Investors are awaiting General Motors’ analyst day to be held on Oct 6, wherein the U.S auto biggie is set to provide key tidbits regarding its e-mobility momentum. Also, watch out for September EV sales in China, set to be released by the China Association of Automobile Manufacturers later this week.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report

Nikola Corporation (NKLA) : Free Stock Analysis Report

Li Auto Inc. Sponsored ADR (LI) : Free Stock Analysis Report

XPeng Inc. Sponsored ADR (XPEV) : Free Stock Analysis Report

Lordstown Motors Corp. (RIDE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research