Everbright Grand China Assets (HKG:3699) Seems To Use Debt Quite Sensibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Everbright Grand China Assets Limited (HKG:3699) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Everbright Grand China Assets

What Is Everbright Grand China Assets's Net Debt?

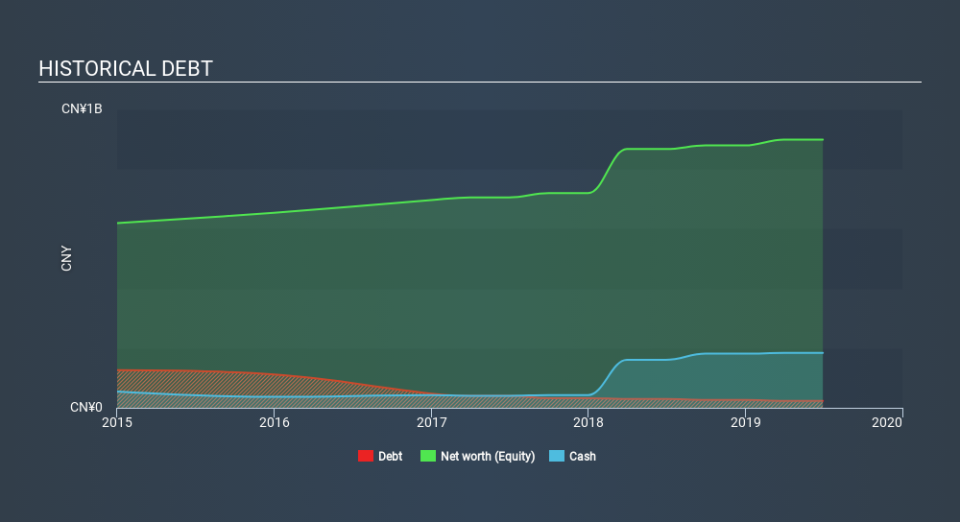

The image below, which you can click on for greater detail, shows that at June 2019 Everbright Grand China Assets had debt of CN¥23.5m, up from CN¥29.5 in one year. However, it does have CN¥184.1m in cash offsetting this, leading to net cash of CN¥160.6m.

A Look At Everbright Grand China Assets's Liabilities

Zooming in on the latest balance sheet data, we can see that Everbright Grand China Assets had liabilities of CN¥29.7m due within 12 months and liabilities of CN¥195.1m due beyond that. Offsetting this, it had CN¥184.1m in cash and CN¥13.2m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥27.5m.

Since publicly traded Everbright Grand China Assets shares are worth a total of CN¥194.9m, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Despite its noteworthy liabilities, Everbright Grand China Assets boasts net cash, so it's fair to say it does not have a heavy debt load!

Everbright Grand China Assets's EBIT was pretty flat over the last year, but that shouldn't be an issue given the it doesn't have a lot of debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Everbright Grand China Assets's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Everbright Grand China Assets may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, Everbright Grand China Assets actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing up

Although Everbright Grand China Assets's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of CN¥160.6m. And it impressed us with free cash flow of CN¥21m, being 119% of its EBIT. So is Everbright Grand China Assets's debt a risk? It doesn't seem so to us. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 4 warning signs for Everbright Grand China Assets you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.