Evercore (EVR) Q2 Earnings Beat Estimates, Stock Rises 2.1%

Evercore Inc. EVR reported adjusted earnings per share of $2.46 in second-quarter 2022, surpassing the Zacks Consensus Estimate of $1.37. However, the bottom line was 22% down from the prior-year quarter’s level of $3.17 per share.

Evercore shares gained 2.1% following the release of earnings, likely reflecting investors' optimism over better-than-expected results. However, the decline in the net revenues of Investment Banking and Investment Management was the undermining factor.

On a GAAP basis, net income available to common shareholders was $95.6 million or $2.33 per share, down from $140.4 million or $3.21 per share reported in the year-ago quarter.

Revenues Decline, Expenses Marginally Up

Total revenues decreased 8% year over year to a record $635.2 million in the reported quarter. Nonetheless, the top line surpassed the consensus estimate of $470.4 million. The decline was mainly due to the loss incurred in the investment funds portfolio. Advisory fees, asset management and administrative fees also declined.

Total expenses marginally increased to $484.7 million from the prior-year quarter.

Adjusted compensation ratio was 59.9%, up from the prior-year period’s 59%.

Adjusted operating margin came in at 24%, down from the prior-year quarter’s 34.4%.

Quarterly Segmental Performance (Adjusted)

Investment Banking: Net revenues declined 8.7% year over year to $619.7 million. Operating income decreased 27% to $149.1 million. Underwriting fees of $13.5 million in the quarter plunged 72% from the prior-year period.

Investment Management: Net revenues were $17.8 million, down 11% from the prior-year quarter’s reading. Operating income was $4.1 million, down 43% from the year-ago quarter’s tally. Assets under Management (AUM) was $10.46 billion as of second-quarter end, down 6% from the year-ago quarter.

Balance Sheet Position

As of Jun 30, 2022, cash and cash equivalents were $444.3 million, and investment securities and certificates of deposit were $1.1 billion. Current assets exceeded current liabilities by $1.4 billion as of the same date.

Capital Deployment Activities

During the second quarter of 2022, approximately 1.6 million shares were repurchased by the company at an average price per share of $109.96.

Further, Evercore returned capital worth $502 million to its shareholders during the first six months of 2022 through dividends and repurchases of 3.6 million shares at an average price of $120.13.

Our Viewpoint

Evercore’s financial performance in the second quarter seems encouraging. Management has shown confidence in its growth strategy and is committed to enhancing its market share in the upcoming period. However, the decline in the company’s total AUM was a matter of concern.

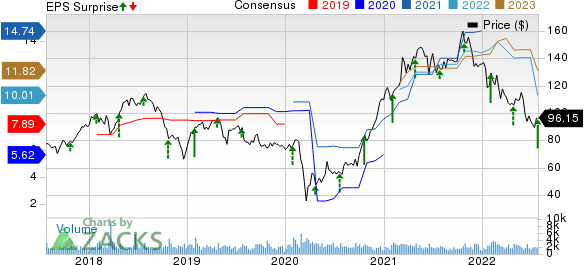

Evercore Inc Price, Consensus and EPS Surprise

Evercore Inc price-consensus-eps-surprise-chart | Evercore Inc Quote

Currently, Evercore has a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1Rank (Strong Buy) stocks here.

Performance of Other Finance Stocks

UMB Financial Corporation UMBF reported a second-quarter 2022 net operating income per share of $2.83, surpassing the Zacks Consensus Estimate of $1.88. The bottom line also compares favorably with the prior-year quarter’s earnings of $1.79.

UMBF’s results were supported by higher revenues, driven by increases in net interest income (NII) and fee income. A rise in average loans was another positive. Yet, increased expenses and deteriorating capital ratios were concerning.

Commerce Bancshares Inc.’s CBSH second-quarter 2022 earnings of 96 cents per share beat the Zacks Consensus Estimate by a penny. The bottom line, however, plunged 27.3% from the prior-year quarter.

Results benefited from an improvement in net interest income, a rise in loan balance and a modest increase in non-interest income. However, an increase in non-interest expenses and higher provisions were the major headwinds for CBSH.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Commerce Bancshares, Inc. (CBSH) : Free Stock Analysis Report

Evercore Inc (EVR) : Free Stock Analysis Report

UMB Financial Corporation (UMBF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research