Eversource's (ES) Earnings and Revenues Beat Estimates in Q3

Eversource Energy ES delivered third-quarter 2018 operating earnings of 93 cents per share, surpassing the Zacks Consensus Estimate of 88 cents by 5.7%. The bottom line also improved 13.4% year over year.

GAAP earnings in the reported quarter were 91 cents compared with 82 cents in the year-ago quarter. The difference between GAAP and operating earnings in the reported quarter was due to an impairment charge of 8 cents relating to the company’s investment in the proposed Access Northeast natural gas pipeline project, along with non-recurring tax benefits of 6 cents related to federal and state tax law changes.

Total Revenues

Eversource’s third-quarter revenues of $2,271.4 million topped the Zacks Consensus Estimate of $1,968 million by 15.4% and also improved 14.2% from the year-ago figure of $1,988.5 million.

Highlights of the Release

In the reported quarter, electric distribution increased 8.7% year over year to 15,316 Gwh.

Operating expenses increased nearly 20.9% year over year to $1,805.4 million, primarily owing to higher expenses from purchased power, fuel and transmission, plus operation and maintenance costs.

Operating income was down 5.9% to $466.3 million while interest expenses were up 15.2% year over year to $125.2 million.

Net income in the quarter under review was $289.4 million, up 11.1% from the year-ago level.

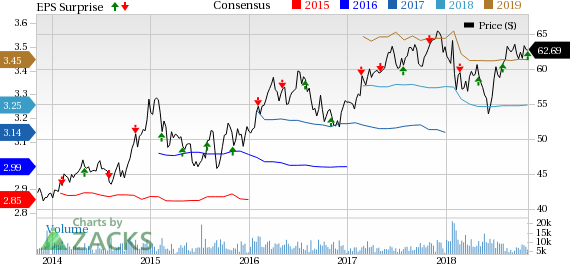

Eversource Energy Price, Consensus and EPS Surprise

Eversource Energy Price, Consensus and EPS Surprise | Eversource Energy Quote

Segmental Performance

Electric Distribution: Earnings from this segment were up 10.4% to $173.8 million. The upside was primarily attributable to higher distribution margins.

Electric Transmission: The bottom line of the segment increased 10.6% year over year to $109.5 million. The upside was primarily attributable to higher level of investment in Eversource’s electric transmission system.

Natural Gas Distribution: This segment recorded a loss of $12.6 million compared with $6.2 million in the year-ago quarter. The segment’s unimpressive third-quarter results were primarily due to higher operation and maintenance expenses.

Water Distribution: Eversource’s water distribution segment, created after the company acquired Aquarion Water Company in December 2017, earned $17.6 million in third-quarter 2018.

Eversource Parent & Other Companies: The segment earned $1.1 million compared with the year-ago quarter’s earnings of $10.2 million.

Financial Highlights

As of Sep 30, 2018, the company’s cash was $59.1 million, up from $38.2 million on Dec 31, 2017.

Its long-term debt was $12.15 billion as of the same date, up from $11.77 billion on Dec 31, 2017.

Cash provided during the first nine months of 2018 in operating activities was $1.40 billion compared with $1.47 billion in the year-ago period.

Guidance

Eversource reaffirmed its 2018 earnings guidance in the range of $3.20-$3.30. Long-term earnings growth of the company is projected in the 5-7% band.

Zacks Rank

Eversource currently carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

Dominion Energy Inc. D reported third-quarter 2018 operating earnings of $1.15 per share, beating the Zacks Consensus Estimate of $1.11 by 3.6%.

Exelon Corporation’s EXC third-quarter 2018 operating earnings of 88 cents per share were on par with the Zacks Consensus Estimate.

NextEra Energy, Inc. NEE reported third-quarter 2018 adjusted earnings of $2.18 per share, which beat the Zacks Consensus Estimate of $2.17 by 0.46%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

Exelon Corporation (EXC) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report

Eversource Energy (ES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research