Evidence Apple iPhone demand is bouncing back in China: BAML

Even as a bitter U.S.-China trade war threatens to dent major tech firms, fears of demand deterioration for Apple’s (AAPL) flagship devices may be overblown, according to at least one major Wall Street firm.

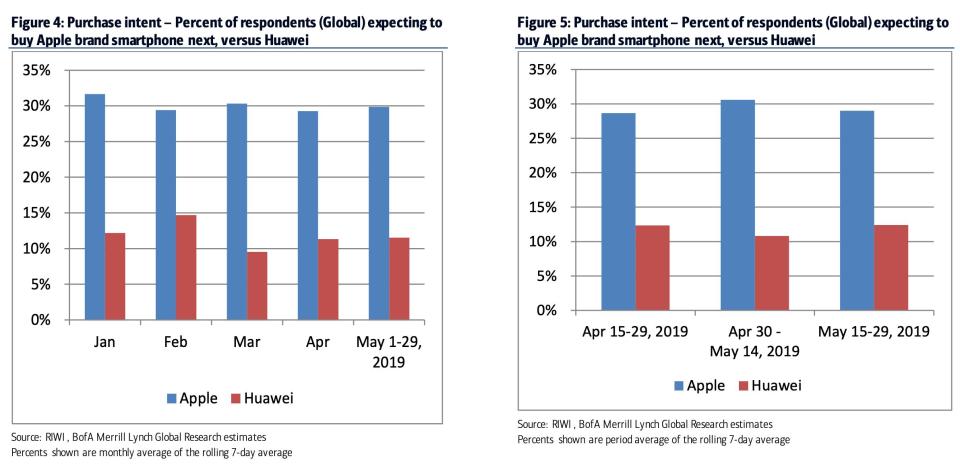

The results of a Bank of America Merrill Lynch survey published Thursday showed “no material reduction in consumer intent to buy iPhones” over the past several months. The survey comprised 194,000 responses from buyers in the U.S., U.K., China and India. Among these respondents, 30% said their intent was to purchase an iPhone as their next phone in May, up from 29% in April.

In China specifically, the percentage of respondents intending to purchase an iPhone as their next phone increased in May to 29%, up from 26% in April. Meanwhile, intent to purchase Huawei-brand phones in China decreased to 25%, down from 28% in April.

“No meaningful impact can be seen so far on demand for iPhones,” BAML analyst Wamsi Mohan wrote in the note.

The results of the survey subvert the concerns many investors have harbored over iPhone demand since the escalation of U.S.-China trade tensions earlier this month. Just last week, UBS slashed its 12-month price target on Apple by $10 to $225, saying Apple was “not immune” to weaker smartphone demand around the world and trade war headwinds. And earlier this week, research firm Gartner reported an overall decline of 2.7% in global smartphone sales during the first quarter, with Apple losing market share as Huawei gained.

The Trump administration’s recent moves to hike up the rate of tariffs on $200 billion worth of Chinese goods and blacklist China’s telecom giant Huawei ignited fears that Beijing would hit back against U.S. companies including Apple.

“It is not possible for us to know for sure how China would react; however, given the estimated 2mn people employed in the Apple supply chain in China, and over 2 mn Apple App developers in China, we view the likelihood of major retaliation against Apple to be low,” Mohan said.

Apple’s services sales in China also appear to have rebounded after the country earlier this year began approving new gaming applications, Mohan added.

Based on third-party data on publisher sales, BAML estimates Apple’s revenue from China’s App store sales jumped to see increases of at least 22% year-over-year for each month between March through mid-May. This more than reversed declines of 4% and 3% year-over-year, respectively, in January and February, Mohan said.

“We view risks related to China tariffs as priced in and maintain our Buy rating on stabilization of iPhones, capital return program, ramp in services and potential for new products,” Mohan said. His price target on shares of Apple is $230.00.

Mohan’s assertions on the resilience of Apple’s product lineup echo those of analysts including Wedbush’s Dan Ives, who last week said he believed there was “a low likelihood that Apple and its iPhones feel the brunt of the tariffs given its strategic importance domestically as well as [Tim] Cook’s ability to navigate these issues in the past with Trump and K Street.”

Apple reported its March quarter sales from Greater China comprised a larger portion of total revenue than during the quarter prior. During a call with investors, CEO Tim Cook said, “We believe strongly in our long-term opportunity in China,” citing, in part, evidence of a stronger Chinese consumer at the time as a result of Beijing’s fiscal stimulus efforts.

Shares of Apple have risen 13% in 2019, versus a gain of 11.5% in the S&P 500.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Tech companies like Lyft want your money – not ‘your opinion’

Levi Strauss shares jump more than 30% above IPO price at open

Facebook sued by Trump administration for alleged ‘discriminatory’ ad practices

Boeing 737 Max groundings ‘pressure’ U.S. economic data: Wells Fargo

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.