Exelixis (EXEL) Q1 Earnings Miss Estimates, Revenues Beat

Exelixis, Inc. EXEL reported breaking earnings in the first quarter of 2021, missing the Zacks Consensus Estimate of earnings of 4 cents. The bottom-line figure declined from the year-ago quarter’s earnings of 15 cents per share due to higher operating expenses.

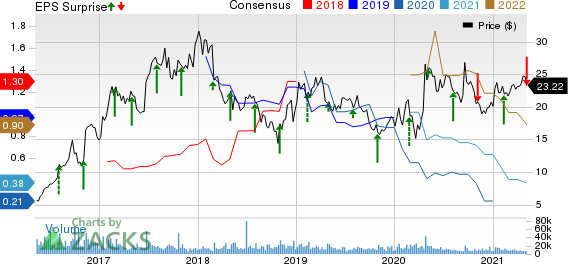

Exelixis, Inc. Price, Consensus and EPS Surprise

Exelixis, Inc. price-consensus-eps-surprise-chart | Exelixis, Inc. Quote

Net revenues came in at $270.2 million, which increased from $226.9 million reported in the year-ago quarter and marginally beat the Zacks Consensus Estimate of $269 million.

Quarter in Detail

Net product revenues came in at $227.2 million, up from $193.9 million reported in the year-ago quarter.

The upside in net product revenues was primarily driven by an increase in sales volume that was partially driven by the strong uptake for the combination therapy of Cabometyx (cabozantinib) and Bristol-Myers’ BMY Opdivo (nivolumab) following FDA approval in January.

Cabometyx generated $223.6 million of revenues. Cabometyx (cabozantinib tablets) are approved for advanced renal cell carcinoma (RCC) and previously treated hepatocellular carcinoma (HCC). Cometriq (cabozantinib capsules) for the treatment of medullary thyroid cancer generated $3.6 million in net product revenues. Exelixis earned $23.8 million in royalty revenues.

Collaboration revenues, comprising license revenues and collaboration services revenues, were $15.5 million in the quarter under review compared with $12.1 million in the year-ago quarter.

In the reported quarter, research and development expenses increased to $159.3 million from the year-ago quarter’s $101.9 million due to a rise in clinical trial costs. Selling, general and administrative (SG&A) expenses were $102.4 million, up from $62.9 million in the year-ago quarter.

Pipeline Update

In January 2021, Exelixis obtained FDA approval for its supplemental new drug application (sNDA) for Cabometyx in combination with Opdivo as a first-line treatment of patients with advanced RCC. Subsequently, in March 2021, Exelixis’ partner Ipsen received approval from the European Commission for this combination as a first-line treatment for advanced RCC.

In April 2021, Exelixis announced that the FDA accepted its IND to evaluate the safety, tolerability, pharmacokinetics and preliminary antitumor activity of XB002 in patients with advanced solid tumors.

In March 2021, it entered a clinical trial collaboration and supply agreement with Merck KGaA and Pfizer PFE for the ongoing phase Ib dose-escalation study, STELLAR-001 (previously called “XL092-001”), adding three new cohorts that will evaluate the safety and tolerability of XL092 in various forms of locally advanced or metastatic urothelial carcinoma (UC).

2021 Guidance Reiterated

Revenues are projected at $1,150-$1,250 million while product revenues are estimated in the range of $950-$1,050 million.

Our Take

Exelixis’ first-quarter results were mixed as earnings missed estimates but revenues beat the same. The approval of Cabometyx in combination with immuno-oncology drug, Opdivo, for advanced RCC should boost sales, going forward, given the market potential.

Exelixis’ shares have gained 15.7% in the year so far against the industry’s loss of 6.8%.

The pipeline progress has been impressive too. Exelixis expects to report top-line results from the phase III COSMIC-312 pivotal study evaluating the combination of cabozantinib and Roche’s RHHBY Tecentriq as a first-line treatment in advanced hepatocellular carcinoma in the second quarter, and file up to three sNDA for cabozantinib across multiple indications by year-end.

However, competition is stiff from the recently-approved combination therapies.

Exelixis currently carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Exelixis, Inc. (EXEL) : Free Stock Analysis Report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research