Exercise Caution on This Upgraded Housing Stock

The shares of homebuilder KB Home (NYSE:KBH) are higher today, thanks to some upbeat analyst attention. Specifically, J.P. Morgan Securities upgraded KBH to "neutral" from "underperform," and lifted its price target on the stock to $23 from $20.50, citing "a more stable demand backdrop following the continued decline of rates." However, KBH stock is flashing a historically bearish technical signal right now, suggesting traders may want to exercise caution.

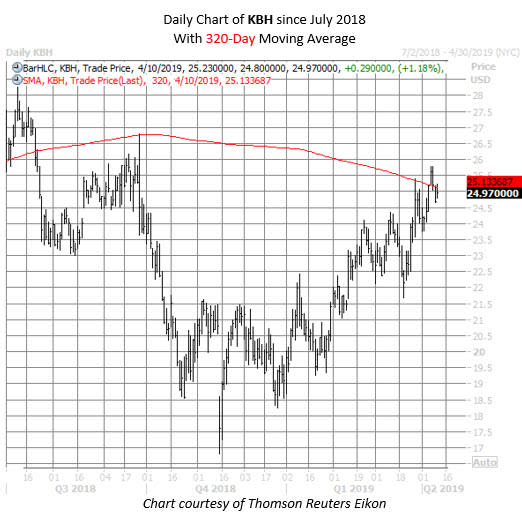

KB Home shares were last seen 1.2% higher at $24.97. The stock has chugged 48% higher since its mid-November low of $16.82, but is now within one standard deviation of its 320-day moving average, after a lengthy stretch below the trendline. In the past three years, there were two similar run-ups to this moving average, after which KBH was lower one month later both times, averaging a steep loss of nearly 19%, per data from Schaeffer's Senior Quantitative Analyst Rocky White. Another drop of this magnitude would put KBH around $20.22.

Most analysts remain skeptical of the homebuilder. Currently, KBH boasts just three "strong buy" ratings, compared to nine tepid "holds" and one "strong sell." Plus, the consensus 12-month price target of $25 is in line with the equity's current price.

In the same vein, options buyers have picked up bearish bets at a faster-than-usual pace during the past two weeks. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock's 10-day put/call volume ratio of 1.54 is in the 78th percentile of its annual range.