What Can We Expect for BioScrip Inc (NASDAQ:BIOS) Moving Forward?

BioScrip Inc (NASDAQ:BIOS), a USD$387.65M small-cap, is a healthcare company operating in an industry, which has experienced tailwinds from issues such as higher demand driven by an aging population and the increasing prevalence of diseases and comorbidities. Healthcare analysts are forecasting for the entire industry, a strong double-digit growth of 10.52% in the upcoming year , and an overall negative growth rate in the next couple of years. Unsuprisingly, this is below the growth rate of the US stock market as a whole. Below, I will examine the sector growth prospects, and also determine whether BioScrip is a laggard or leader relative to its healthcare sector peers. Check out our latest analysis for BioScrip

What’s the catalyst for BioScrip’s sector growth?

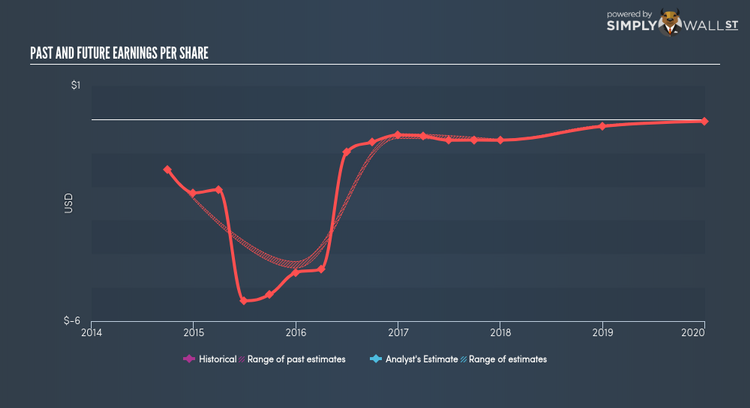

Providers that are finding it harder to profit from further cost and operational efficiencies after picking the low-hanging fruit are beginning to turn their attention to more transformative initiatives to bend the cost curve. In the past year, the industry delivered growth of 8.11%, though still underperforming the wider US stock market. BioScrip is neither a lagger nor a leader, and has been growing in-line with its industry peers at around 8.35% in the prior year. However, analysts are expecting the company to accelerate ahead of its peers over the next year, and deliver a 49.67% growth next year.

Is BioScrip and the sector relatively cheap?

The healthcare sector’s PE is currently hovering around 23x, relatively similar to the rest of the US stock market PE of 20x. This illustrates a fairly valued sector relative to the rest of the market, indicating low mispricing opportunities. Furthermore, the industry returned a similar 11.55% on equities compared to the market’s 10.46%. Since BioScrip’s earnings doesn’t seem to reflect its true value, its PE ratio isn’t very useful. A loose alternative to gauge BioScrip’s value is to assume the stock should be relatively in-line with its industry.

What this means for you:

Are you a shareholder? BioScrip’s industry-beating future is a positive for shareholders, indicating they’ve backed a fast-growing horse. If you’re bullish on the stock and well-diversified by industry, you may decide to hold onto BioScrip as part of your portfolio. However, if you’re relatively concentrated in healthcare provider, you may want to value BioScrip based on its cash flows to determine if it is overpriced based on its current growth outlook.

Are you a potential investor? If BioScrip has been on your watchlist for a while, now may be the time to enter into the stock, if you like its growth prospects and are not highly concentrated in the healthcare provider industry. Before you make a decision on the stock, take a look at BioScrip’s cash flows and assess whether the stock is trading at a fair price.

For a deeper dive into BioScrip’s stock, take a look at the company’s latest free analysis report to find out more on its financial health and other fundamentals. Interested in other healthcare stocks instead? Use our free playform to see my list of over 1000 other healthcare companies trading on the market.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.