What to Expect From Groupon (GRPN) this Earnings Season?

Groupon, Inc. GRPN is scheduled to report first-quarter 2021 results on May 6.

The Zacks Consensus Estimate for loss per share has been steady at 58 cents in the past 30 days. In the first quarter of 2020, Groupon had reported non-GAAP loss per share of $1.63.

The Zacks Consensus Estimate for first-quarter revenues is pegged at $228.3 million, which indicates a decline of 39% from the year-ago quarter’s reported figure.

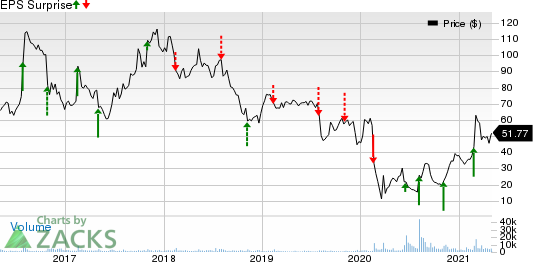

Notably, the company’s earnings surpassed the Zacks Consensus Estimate in all the last four quarters. It has a trailing four-quarter earnings surprise of 148.93%, on average.

Groupon, Inc. Price and EPS Surprise

Groupon, Inc. price-eps-surprise | Groupon, Inc. Quote

Q4 Recap

In fourth-quarter 2020, the company generated revenues of $343.1 million that beat the Zacks Consensus Estimate by 21.7%. However, the figure declined 44% on a year-over-year basis.

The company reported non-GAAP earnings of 51 cents per share, versus the Zacks Consensus Estimate of a loss of 18 cents. The company had reported non-GAAP earnings of $1.44 in the prior-year quarter.

Let’s see how things have shaped up prior to this announcement.

Factors to Note

Groupon’s first-quarter performance is expected to have been cushioned by its pivot strategy and restructuring efforts. As part of its pivot strategy, Groupon has been expanding inventory to boost billings growth as well as improve purchase frequency and modernizing marketplace.

Moreover, the company is reducing restrictions on its deeply-discounted deals and enabling customers to purchase such deals many times. Efforts to improve quality and all-time-available inventory are likely to have attracted more consumers to its platform in the first quarter.

In fourth-quarter 2020, Groupon rolled out an integration with Booker with its Connect API platform, to enable smooth integration of quality bookable supply into its marketplace. Booker is a popular beauty & wellness booking platform in North America. This is likely to have contributed to top-line performance in the to-be-reported quarter.

The company is also concentrating on local experiences marketplace as it presents significant top line growth opportunity.

Groupon has been adding new features to its platform like map-based search feature along with optimizing relevance and search results to augment customer experience.

The daily deals provider is also working on improving merchant experience on its platform. The company rolled out features like sponsored listings tool and Google two-way calendar sync that will facilitate merchants to manage booking leveraging the Google Calendar. These initiatives are likely to have positively impacted the top line in the to-be-reported quarter.

Nonetheless, Groupon’s first-quarter revenues are likely to reflect the negative impact of the ongoing pandemic on restaurants and travel bookings. Further, these sectors are likely to have been hit hard due to the re-imposition of shelter-in-place guidelines across several countries.

Further, higher investments on platform enhancement amid intense competition in the e-commerce space are anticipated to have put pressure on first-quarter EBITDA.

What the Zacks Model Unveils

Our proven model does not predict an earnings beat for Groupon this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Groupon has an Earnings ESP of 0.00% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks That Warrant a Look

Fair Isaac Corporation FICO has an Earnings ESP of +15.94% and carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

CDW Corporation CDW has an Earnings ESP of +0.51% and carries a Zacks Rank of 2, at present.

Synaptics Incorporated SYNA has an Earnings ESP of +1.6% and currently carries a Zacks Rank of 2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Groupon, Inc. (GRPN) : Free Stock Analysis Report

Synaptics Incorporated (SYNA) : Free Stock Analysis Report

Fair Isaac Corporation (FICO) : Free Stock Analysis Report

CDW Corporation (CDW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research