Expensive as It Is, Amazon.com, Inc. Stock Still Is a Great Buy

Amazon.com, Inc. (NASDAQ:AMZN) has been a force of nature; every investor knows this name. Despite its lofty market cap of $763 billion, AMZN hasn’t been sluggish when it comes to performance. Shares have exploded more than 60% over the past 12 months and while 2018 has been volatile, Amazon stock has steadily risen more than 35%.

So what do investors do now? Is there still time to hop on the Amazon bandwagon?

The Problem With Amazon

By traditional metrics, Amazon is overvalued in seemingly every way, and it’s been that way for years. In the early days, it was just a convenient online shopping platform. It’s biggest asset was Prime and, while Prime didn’t offer a whole lot aside from free two-day shipping, shipping was a service consumers had to pay for on virtually every other site.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

While revenues continued to grow 20% or more annually, there wasn’t much in the way of bottom-line profits. In fact, that’s still largely the case today when you look at Amazon’s net income vs. its massive market cap. Those net margins become even more glaring when compared to a titan like Apple Inc. (NASDAQ:AAPL).

But then something interesting happened: the floodgates opened. Online sales began to explode and traditional retailers were being squeezed big time. Remember how many filed for bankruptcy in 2017? But Amazon didn’t just ride this new wave of momentum, it was the wave.

Shares have burst higher by more than 260% over the past 36 months, leaving many investors who previously scoffed at AMZN’s high valuation in a bind. Do they chase Amazon stock now with this massive market cap or wait for a better opportunity?

To answer that question, we need to look at its fundamentals. But like its founder and CEO Jeff Bezos, traditional doesn’t work here.

A price-to-earnings ratio never fit Amazon stock. If investors used that on Amazon five or 10 years ago, many recoiled by its egregiously high number. Yet here we are, Amazon still is trading at 128 times this year’s earnings estimates.

Amazon’s Fundamentals

No, with Amazon you need a different approach as well as a long-term one. For starters, the company entered the cloud business through Amazon Web Services. “Entered” the cloud puts it lightly, though. Amazon is a market-share leader, even beating out names like Microsoft Corporation (NASDAQ:MSFT) and Alphabet Inc (NASDAQ:GOOGL, NASDAQ:GOOG).

As a side note, both AMZN and GOOGL are integrated with Salesforce.com, inc. (NASDAQ:CRM) so as they grow, you know CRM is growing too.

In any regard, the cloud has helped Amazon accelerate its revenue growth and has added some cushion to its bottom line. I still believe the cloud industry is in its early innings and in that respect Amazon has a long ways to go. Infusing artificial intelligence, something Amazon certainly has the resources and foresight to do, will only accelerate that efficiency.

In retail, Amazon now has 100 million Prime members. Maybe not all of them pay the now-$120 annual membership, but based on some back-of-the-envelope math, the company should rake in $10 billion to $12 billion per year in Prime memberships.

While that’s a great, stable source of revenue it’s also an amazing cash-flow generator. To have that kind of subscription revenue, something that gives software companies a big valuation on Wall Street, is a big plus when it comes to fueling further growth opportunities.

One of those opportunities has come in bricks-and-mortar. Whole Foods was already profitable when AMZN took over, but it had little growth. AMZN investors have rarely cared about profits in the short-term.

So buying WFM gives Amazon the time it needs to experiment with pricing, technology, delivery and other synergies Amazon can leverage through its Prime membership services and existing business model. Don’t discount how big grocery retail can be for this company.

We can judge AMZN stock through numbers, but what it really comes down to is scope. And at present, it’s far from being done.

Trading Amazon Stock

I’m not saying investors can’t evaluate Amazon from a financial basis. But sometimes it’s just best to go where the momentum is taking you, rather than trying to nitpick it and fight the flow. For AMZN, it’s no different.

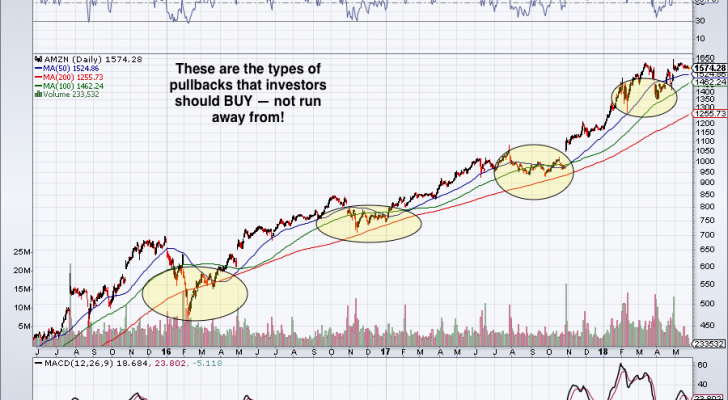

But one downside to Amazon stock has always been volatility. We’ve seen shares lose one-third of their value in less than two months. While violent, these are exactly the types of pullbacks that long-term growth investors should seize, not sell.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell was long GOOGL and CRM.

More From InvestorPlace

The post Expensive as It Is, Amazon.com, Inc. Stock Still Is a Great Buy appeared first on InvestorPlace.