Facebook (NASDAQ:FB) is Zigging Where it Should be Zagging

This article first appeared on Simply Wall St News.

Facebook, Inc. (NASDAQ: FB) was recently hit with a two-punch combo – a 6-hour system outage combined with a whistleblower testifying before the Senate Committee.

That is not the first tango for Facebook as it experienced similar situations in the past, albeit not strictly at the same time. Yet, it contributed to the prolonged decline of the stock that is now underperforming the broad market year to date.

Check out our latest analysis for Facebook

Bad News Come in Pair

After a global outage on October 4th, Facebook issued a statement attributing it to the configuration changes on the backbone routers that coordinate network traffic between the data centers. The company is transparent that there was no malicious activity behind the outage but an internal configuration mistake.

Meanwhile, former Facebook employee and whistleblower Frances Haugen testified before the Senate Commerce Committee, arguing that the company withholds crucial information from the public and is aware of the negative effect that its platforms can have on its users. Facebook is now sitting at the crossroads where there are threats from the higher regulations (or breakdown) and users realizing the dangers of data collection and algorithmically-enhanced social media addiction.

Yet, the company doesn't seem to realize this just yet, as they just shut down the developer who created "Unfollow Everything," a browser extension designed to control the newsfeed by filtering out the content.

What does the future of Facebook look"like?

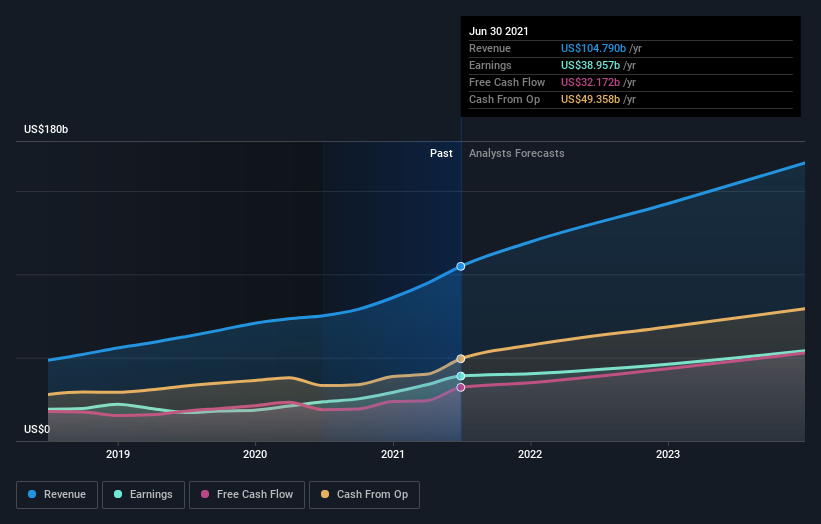

Future outlook is an important aspect when you’re looking at buying a stock. With profit expected to grow by 49%, the future seems bright for Facebook.

It looks like higher cash flow is on the cards for the stock, which should feed into a higher share valuation. Furthermore, the company looks undervalued according to our Disounted Cash Flow Model.

What this means for you:

While Facebook is unquestionably doing a good job for the shareholders, and the analysts remain optimistic, there are growing issues about the company.

The changes, like with the iOS 14.5, are pressuring the advertisement margins as users are overwhelmingly denying tracking permissions. An adaptation to these data tracking changes arguably presents a bigger issue than the latest criticism about issues that are solvable – not straightforward, but not impossible for a company worth almost US$1 trillion.

Thus, the company should prioritize repairing its image in the short term, even if it means losing some revenue in the medium term so that it can successfully execute ambitious projects like the Metaverse in the long term.

Are you a stockholder? Since FB is currently below the industry PE ratio, it can be a great time to increase your holdings in the stock. With an optimistic outlook on the horizon, it seems like this growth has not yet been fully factored into the share price. However, other factors such as capital structure to consider could also explain the current price multiple.

Are you a potential investor? If you’ve been keeping an eye on FB for a while, now might be the time to enter the stock. Its prosperous future profit outlook isn’t fully reflected in the current share price yet, which means it’s not too late to buy FB. But before you make any investment decisions, consider other factors such as the track record of its management team to make a well-informed investment decision.

It can be quite valuable to consider what analysts expect for Facebook from their most recent forecasts. Luckily, you can check out what analysts are forecasting by clicking here.

If you are no longer interested in Facebook, you can use our free platform to see our list of over 50 other stocks with high growth potential.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com