Facebook Stock (FB) Will Benefit from Facebook Watch

Facebook Inc. (NASDAQ:FB) has had quite the run as a publicly traded company. Since its much-talked about IPO, shares have steadily risen as the company has seen tremendous user and revenue growth. As FB grows from its base of two billion users, investors will be looking for the impressive growth to continue. With the launch of Facebook Watch and a push into original content and sports, Facebook stock will continue to be a winner

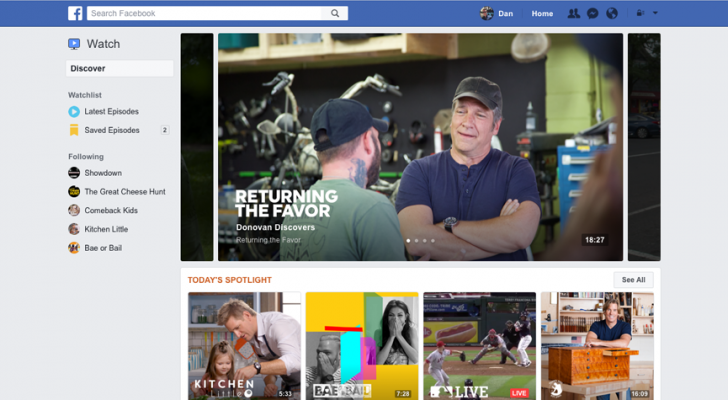

Source: Facebook

If you’re one of the 236 million monthly active users in the United States or Canada, chances are you’ve seen information on Facebook Watch. The new video playing service from Facebook is the company’s new way to compete for eyeballs and time spent on its site in a competitive market featuring Netflix, Hulu, YouTube and more. If you play a video on Facebook currently, the site will tell you that you can save it to watch later and will suggest more videos you might enjoy. These are all a push of Facebook to try and score up more time on their site and ultimately more advertising revenue. If successful, Facebook Watch will be a major win for shareholders of Facebook stock.

Facebook is pushing into original content and attempting to score a load of videos that will keep people coming back or watching longer videos (Facebook Watch even has a 10 minutes or more section). One of the flagship shows on Facebook Watch is “Ball in the Family”, which could be a slam dunk for the new Facebook Watch platform.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Facebook Scores Slam Dunk with Ball Family

“Ball in the Family” centers around the Ball family, led by outspoken patriarch Lavar Ball. The reality show features 15 minute videos and provides a look at Lavar, his wife Tina, and three boys, who are all basketball stars. The series is made by the Bunin/Murray Production Company, the same name behind shows like “Keeping Up With the Kardashians” and “MTV Real World”. The Ball family reminds me a little bit of the Kardashians in fact, as people love them or hate them and tune in just to see how outrageous each episode is.

Lavar Ball pitched this reality show to several networks, but ultimately decided on putting it on Facebook. It’s not public what other networks actually wanted the show, but given the interest of the family and the fact that oldest son Lonzo will play in the NBA this season, I’m guessing some networks wanted this show.

The Balls are well followed on Twitter, Inc. (NYSE:TWTR) Lavar has 155,000 followers. The three sons Lonzo, LaMelo, and LiAngelo have 404,000, 218,000, and 137,000 respectively. The Big Baller Brand also has 135,000 followers. On Facebook the show’s page has 297,000 followers. Viewership was strong for the first episode before dropping off during the second episode. The first episode had 8.4 million views.

The second episode fell to 895,000 viewers. It would appear many tuned into the first episode just to see the family and give it a chance. The third episode had 858,000 viewers, a slight drop, but both these episodes have decent numbers for Facebook and show there are nearly one million people willing to tune into this weekly show.

Along with “Ball in the Family,” Facebook has been able to score some big partners to produce content for it on the Facebook Watch platform. Discovery Communications (NASDAQ:DISCA) signed on to create 23 shows for the Facebook Watch platform. These shows will range from four minutes to fifteen minutes. This includes shows like “Celebrity Animal Encounters” from Animal Planet, “Still a Mystery” from Investigation Discovery and a “Say Yes to the Dress” spin-off from TLC.

Other partners for Facebook Watch include A&E with a dating show, Mike Rowe (of “Dirty Jobs” fame) with a new series, a virtual dating show from The Scene, a Military homecoming show from Poke My Heart, and a Humans of the New York series from the popular photojournalist page.

Sports a Major Catalyst for Facebook Stock

Along with its commitment to scripted shows, Facebook stock could get a boost as it continues to become a player in live sports content. As people continue to cut the cord, watch fewer commercials and watch television days later, advertisers continue to see the value in live sports, which aren’t as easily DVR’d by viewers.

Facebook bid $610 million for the streaming rights for the Indian Premier League cricket matches. That’s right, FB offered over half a billion for a sport most Americans don’t understand or watch. Remember Facebook is a much more global company and with limited American sports streaming offerings coming up every year, this may have been an incredibly smart move.

First, Facebook almost won, only beat out by a big overall television and streaming deal by Twenty-First Century Fox Inc. (NASDAQ:FOXA). Second, it shows how serious the company is about video and sports. Mark Zuckerberg told investors on the first quarter earnings call that Facebook would try licensing sports games as a goal of having anchor content for video.

Facebook stock could get a boost if its sports plans work out. A small deal was signed between FB and several College Football teams to show 15 games this season on the platform. Facebook offers many interactive features during the games, including chat. For its ability to engage fans in conversation during games, Twitter and Facebook have been seen as huge disruptors in the future of sports streaming.

Many analysts and industry leaders believe Facebook’s failed bid on cricket will lead to a bid on upcoming National Football League content. A deal between the NFL and Verizon worth $1 billion expires at the end of the season. Unlike other deals, this covers nearly every game for the entire season. The price tag will definitely come in above the $1 billion for four years paid by Verizon. Facebook stock could see a big jump if it could secure these rights, as it would bring lucrative content and possible advertising monetization to the company’s video efforts.

Huge User Base Offers Great Monetization Opportunities

FB has some of the most valuable brands on the planet in terms of number of users and engagement. In June 2017 when Facebook’s namesake app crossed the two billion user mark, it also had impressive numbers for its other owned properties. Instagram had 700 million users. WhatsApp and the Facebook Messenger service each had 1.2 billion users, trailing only YouTube for second place (1.5 million).

Facebook has bid on NFL rights in the past and I don’t see that stopping. The company lost out recently to Amazon, Inc. (NASDAQ:AMZN) in a battle of streaming rights for 10 Thursday Night Football games. Amazon won with a $50 million bid, which was a big increase from the $10 million Twitter paid during the first year these rights were offered, which Facebook also bid on.

Reports say Facebook is ready to spend up to $1 billion on original video content through 2018. While this is significantly lower than the amount being spent by Netflix or Amazon to acquire content, it shows the commitment Facebook is putting on the Facebook Watch platform. As the recent bid on cricket content shows, FB may be willing to place large bets on content it believes could really make Facebook Watch a destination to view content and show advertising during videos.

The time in now to tune in to Facebook stock and see what the future holds. If you think Facebook Watch can help Facebook compete in the original content market, Facebook stock could be worth a look here, even as it chases all-time high levels.

Chris Katje is a freelance finance writer. You can follow him on Twitter @chriskatje. At the time of writing, Chris Katje had no positions in stocks in this article.

More from InvestorPlace

The post Facebook Stock (FB) Will Benefit from Facebook Watch appeared first on InvestorPlace.