Can These Factors Give You An Edge In 1st Constitution Bancorp (NASDAQ:FCCY)?

1st Constitution Bancorp’s (NASDAQ:FCCY) profitability and risk are largely affected by the underlying economic growth for the region it operates in US given it is a small-cap stock with a market capitalisation of US$177.2m. Since banks make money by reinvesting its customers’ deposits in the form of loans, strong economic growth will drive the level of savings deposits and demand for loans, directly impacting the cash flows of those banks. Following the Financial Crisis in 2008, a set of reforms termed Basel III was enforced to bolster risk management, regulation, and supervision in the financial services industry. The Basel III reforms are aimed at banking regulations to improve financial institutions’ ability to absorb shocks caused by economic stress which could expose banks like 1st Constitution Bancorp to vulnerabilities. Since its financial standing can unexpectedly decline in the case of an adverse macro event such as political instability, it is important to understand how prudent the bank is at managing its risk levels. High liquidity and low leverage could position 1st Constitution Bancorp favourably at the face of macro headwinds. A way to measure this risk is to look at three leverage and liquidity metrics which I will take you through today.

Check out our latest analysis for 1st Constitution Bancorp

Why Does FCCY’s Leverage Matter?

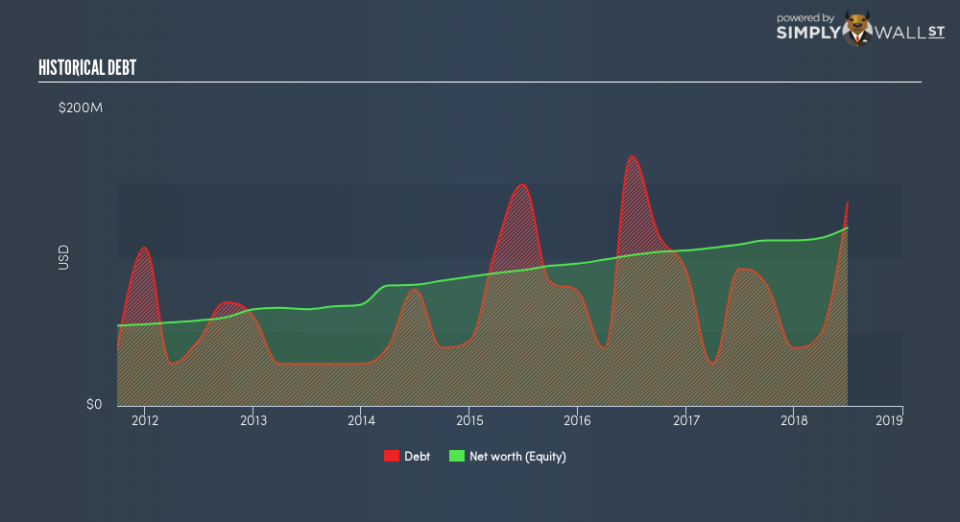

A low level of leverage subjects a bank to less risk and enhances its ability to pay back its debtors. Leverage can be thought of as the amount of assets a bank owns relative to its shareholders’ funds. Though banks are required to have a certain level of buffer to meet its capital requirements, 1st Constitution Bancorp’s leverage level of 10.22x is very safe and substantially below the maximum limit of 20x. With assets 10.22 times equity, the banks has maintained a prudent level of its own fund relative to borrowed fund which places it in a strong position to pay back its debt in times of adverse events. If the bank needs to increase its debt levels to firm up its capital cushion, there is plenty of headroom to do so without deteriorating its financial position.

What Is FCCY’s Level of Liquidity?

Due to its illiquid nature, loans are an important asset class we should learn more about. Normally, they should not exceed 70% of total assets, but its current level of 72.5% means the bank has lent out 2.5% above the sensible upper limit. This level implies dependency on this particular asset class as a source of revenue which makes the bank more likely to be exposed to default compared to its competitors with less loans.

Does FCCY Have Liquidity Mismatch?

A way banks make money is by lending out its deposits as loans. These loans tend to be fixed term which means they cannot be readily realized, however, customer deposits are liabilities which must be repaid on-demand and in short notice. The discrepancy between loan assets and deposit liabilities threatens the bank’s financial position. If an adverse event occurs, it may not be well-placed to repay its depositors immediately. Since 1st Constitution Bancorp’s loan to deposit ratio of 93.2% is higher than the appropriate level of 90%, this level positions the bank in a risky spot given the potential to cross into negative liquidity disparity between loan and deposit levels. Essentially, for $1 of deposits with the bank, it lends out more than $0.9 which is risky.

Next Steps:

Keep in mind that a stock investment requires research on more than just its operational side. There are three pertinent factors you should further research:

Future Outlook: What are well-informed industry analysts predicting for FCCY’s future growth? Take a look at our free research report of analyst consensus for FCCY’s outlook.

Valuation: What is FCCY worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether FCCY is currently mispriced by the market.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.