Factors Likely to Impact Estee Lauder's (EL) Q3 Earnings

The Estee Lauder Companies Inc. EL is slated to release third-quarter fiscal 2018 results on May 2, before the opening bell. We note that this cosmetics giant has delivered positive earnings and sales surprise for 14 and four consecutive quarters, respectively. This exceptional performance can be attributed to the company’s well-chalked buyouts, innovations, savings efforts, strong market reach as well as robust online and travel retail network.

On the flip side, the company has been facing receding traffic in the U.S. brick-and-mortar stores. Moreover, the company’s gross margins have been strained for a while now, thanks to a mix of factors.

On that note, let’s see if Estee Lauder’s growth can counter the aforementioned hurdles and aid it in maintaining its spectacular surprise streak alive this time.

Acquisitions to Boost Results

This cosmetics stalwart has made several strategic acquisitions to enhance its portfolio. The acquisitions of BECCA and Too Faced have been strengthening its fastest-growing prestige portfolio and contributed nearly 2 percentage points to sales in the second quarter of fiscal 2018. Estee Lauder’s investment in DECIEM — a fast-growing multi-brand company — is likely to aid beauty sales in the forthcoming periods. The company’s previous moves in this regard include the buyout of By Kilian, RODIN olio lusso and GLAMGLOW. Apart from skin care, Estee Lauder has also acquired high-end fragrance and lifestyle brands such as Le Labo (The Lab) and Editions de Parfums Frédéric Malle.

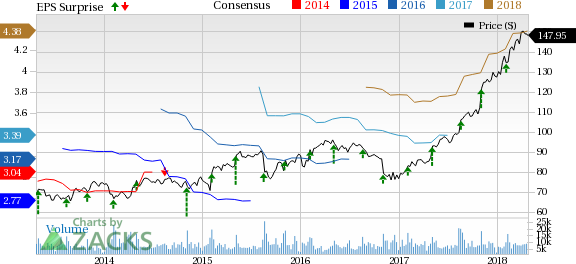

The Estee Lauder Companies Inc. Price, Consensus and EPS Surprise

The Estee Lauder Companies Inc. Price, Consensus and EPS Surprise | The Estee Lauder Companies Inc. Quote

E-commerce & Travel Retail to Drive Growth

Estee Lauder has a strong online business and the company expects it to be a major growth catalyst in the upcoming years. The company has been constantly implementing digital experiences such as online booking for each store appointment, omni-channel loyalty programs and advanced mobile services. Further, Estee Lauder is focused on widening its global online presence by adding new sites and expanding retailer distributions.

Estee Lauder continues to focus on enhancing travel retail business, which has lately emerged a major sales driver for the company. Management stated that growth in this category is majorly fueled by the company’s continued investments in emerging markets, particularly in Asia, along with double-digit increases in five of its biggest brands in the travel retail network. Well, the company is committed toward undertaking greater strategic efforts to enhance travel retail business.

Forecasts Look Bright

Buoyed by the aforementioned factors, the company expects adjusted earnings in the range of $1.02-$1.04 per share for the third quarter, which marks a considerable increase from the previous projection of 91 cents. On a constant currency basis, adjusted earnings are expected to improve 7-9%. The Zacks Consensus Estimate of earnings for the said period is currently pegged higher at $1.07.

Further analysts polled by Zacks expect revenues of $3,234 million, up 13.2% from the prior year. Also, management predicts sales growth of 12-13% in the third quarter. Foreign currency is expected to positively impact sales by 3%. On a constant currency basis, sales are expected to improve 9-10%.

Can Efforts Offset Hurdles?

Persisting concerns surrounding lower sales in North America due to a decline in retail traffic in the U.S. brick-and-mortar stores has been a concern for Estee Lauder for quite some time. Also, the company is cautious about social, economic and political issues that could affect consumer spending in few countries. Further, the company has been struggling with gross margin declines for more than four quarters now.

Nevertheless, we expect the company to overcome the impacts of such hurdles with the help of the aforementioned growth drivers. Moreover, management expects continued growth opportunities in the global prestige beauty industry, which is anticipated to grow 5% in fiscal 2018. All these upsides, along with expected gains from the recently enacted tax reforms keep management encouraged about continuing with its sturdy performance in the second half and fiscal 2018. Well investors’ too are optimistic regarding the stock, evident from its astounding 69.4% surge in the past year, while the industry rallied 35.1%.

All said, lets now finally take a look at what the Zacks Model unveils regarding Estee Lauder’s performance in the to-be-reported quarter.

Zacks Model

Our proven model shows that Estee Lauder is likely to beat earnings estimates this quarter. A stock needs to have a positive Earnings ESP and a Zacks Rank #1(Strong Buy), 2(Buy) or 3(Hold) for this to happen. You can see the complete list of today’s Zacks #1 Rank stocks here

Estee Lauder has an Earnings ESP of +0.46% and has a Zacks Rank #3 that makes us reasonably confident of an earnings beat. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks With Favorable Combinations

Here are some more companies which, according to our model, have the right combination of elements to deliver earnings beat.

The J. M. Smucker Company SJM has an Earnings ESP of +0.03% and a Zacks Rank #2.

Church & Dwight Co., Inc. CHD has an Earnings ESP of +0.52% and a Zacks Rank #3.

Sysco Corporation SYY has an Earnings ESP of +0.77% and a Zacks Rank #3.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Estee Lauder Companies Inc. (EL) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research