Factors to Note Before Service Corporation's (SCI) Q4 Earnings

Service Corporation International SCI is likely to report growth in the top and bottom lines when it releases fourth-quarter 2020 numbers on Feb 15. The Zacks Consensus Estimate for revenues is pegged at $974 million, which suggests a rise of 14.5% from the figure reported in the prior-year quarter.

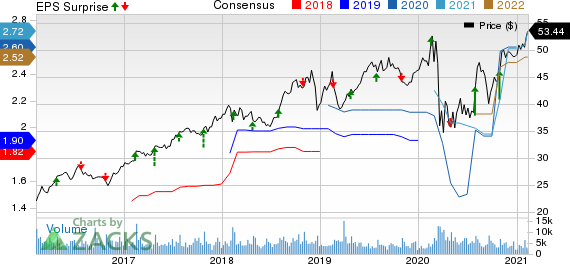

The Zacks Consensus Estimate for the bottom line has gone up 12.3% in the past 30 days to 91 cents per share, which indicates a jump of 51.7% from the year-ago quarter’s reported figure. Notably, the bottom line of this provider of deathcare products and services outpaced the Zacks Consensus Estimate by 83.7% in the last reported quarter and it has a trailing four-quarter earnings surprise of 55.2%, on average.

Service Corporation International Price, Consensus and EPS Surprise

Service Corporation International price-consensus-eps-surprise-chart | Service Corporation International Quote

Key Factors to Note

The company has been gaining on increased funerals performed due to the coronavirus pandemic, which along with an improved cost structure aided its performance in third-quarter 2020. The bottom line was backed by increased gross profit stemming from greater funeral services and burials performed. Also, robust growth in recognized preneed revenues in the company’s Cemetery business was a driver, though preneed sales have been soft in the Funeral segment due to declines at core funeral locations and a fall in preneed production in the non-funeral home channel.

Nonetheless, with curbs being lifted, Service Corporation has seen unexpected increases in its preneed cemetery sales production. On its third-quarter earnings call, management said that it continued to witness such trends in October, though at a slower rate than the third quarter. Apart from this, the company saw considerable growth in the number of families opting for memorial services during the third quarter. Management expects a high-single-digit increase in funeral volumes and atneed cemetery revenues in the fourth quarter of 2020. Such trends bode well for the quarter under review.

Notably, management had raised its bottom-line view for 2020, when it reported the third-quarter results. For 2020, Service Corporation now envisions adjusted earnings per share of $2.50-$2.75 compared with $1.78-$2 anticipated earlier. That being said, elevated costs amid the COVID-19 pandemic are a concern.

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Service Corporation this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Service Corporation currently has a Zacks Rank #1 and an Earnings ESP of +3.68%.

Other Stocks With Favorable Combinations

Here are some other companies you may want to consider, as our model shows that these too have the right combination of elements to post an earnings beat this season.

Monster Beverage MNST has an Earnings ESP of +21.81% and a Zacks Rank #2, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Boston Beer SAM currently has an Earnings ESP of +31.68% and a Zacks Rank #3.

Campbell Soup CPB has an Earnings ESP of +3.08% and a Zacks Rank #3, currently.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Campbell Soup Company (CPB) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

The Boston Beer Company, Inc. (SAM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research