Factors Setting the Tone for Coca-Cola's (KO) Q2 Earnings

The Coca-Cola Company KO is slated to report second-quarter 2018 results on Jul 25, before the opening bell. The company boasts an impressive surprise history, having surpassed earnings estimates in 15 of the trailing 16 quarters.

The Zacks Consensus Estimate for the second quarter is pegged at 60 cents, which reflects an improvement of 1.7% from 59 cents in the year-ago quarter. Estimates have been stable in the past 30 days.

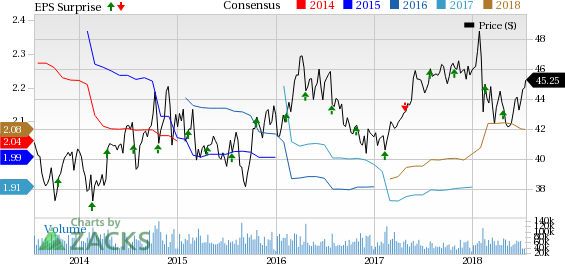

Coca-Cola Company (The) Price, Consensus and EPS Surprise

Coca-Cola Company (The) Price, Consensus and EPS Surprise | Coca-Cola Company (The) Quote

Analysts polled by Zacks expect Coca-Cola’s total quarterly revenues to be $8,571 million, reflecting a decline of 11.7% from the prior-year quarter. In fact, the company has been witnessing a year-over-year decline in revenues for the last few quarters, primarily due to weak volumes and structural headwinds.

In addition, currency translation risks remain concerns for the company. In second-quarter 2018, currency headwinds are likely to impact operating income by about 2% and net revenues by 0-1%, both on a non-GAAP basis.

How Things Are Shaping Up For This Announcement

Coca-Cola remains focused on brand innovation, packaging and routes-to-market. Also, the company is investing in newer revenue platforms to cushion sales and profits. Moreover, it is likely to gain from acquisitions. In 2017, the beverage giant made an important addition to its portfolio beyond sparkling soft drinks, with the acquisition of Topo Chico premium sparkling mineral water brand in the United States.

Also, it entered the fast-growing U.S. ready-to-drink coffee category. Furthermore, Coca-Cola’s robust portfolio of globally recognized brands, along with quality beverages — including low- and no-calorie options, provides a competitive advantage. These factors are likely to contribute to upcoming quarterly results.

The company has been refranchising its bottling operations, which are aiding margins. Refranchising efforts are likely to result in higher operating margins, lower capital spending and improved return on invested capital.

In fact, cost-saving efforts are already contributing to the company’s margins. Gross margin expanded 270 basis points (bps) year over year in first-quarter 2018. Also, operating margin grew 600 bps, given the divestitures of lower-margin bottling businesses and ongoing productivity efforts. This is likely to continue in the second quarter as well.

Notably, the company is on track to deliver savings of about $3.8 billion by 2019 through its productivity programs.

Segmental Discussion

Europe, Middle East and Africa or EMEA

Coca-Cola’s EMEA division is expected to continue with its momentum. Revenues at the segment were up 13% year over year in first-quarter 2018. For the second quarter, the Zacks Consensus Estimate for the EMEA segment’s revenues is pegged at $2,104 million, reflecting an increase of 3.3% year over year and 14.3% on a sequential basis.

Further, the segment’s estimates for operating income are pegged at $1,082 million, almost flat with the prior-year quarter but reflect sequential growth of 18.1%.

Latin America

In the Latin America division, Coca-Cola has been gaining from the strong price/mix in its Mexico and South Latin businesses. The segment’s revenues improved 8% in the last reported quarter. The Zacks Consensus Estimate for the segment’s revenues is pegged at $991 million, mirroring an increase of 4.3% from the prior-year quarter but a marginal decline of 0.7% from the last reported quarter.

Further, the segment’s operating income estimates stand at $586 million, up 5.2% year over year and 2.1% sequentially.

North America

The company delivered a robust performance in the North America region. However, the segment’s price/mix declined year over year, owing to a low-single-digit underlying price. Also, higher freight costs remained a major headwind in the last reported quarter, primarily in North America. Nevertheless, management remains encouraged to earn price and value from this market. Also, revenues in the region grew 11% year over year in the last reported quarter. Further, the second quarter consensus mark for revenues stands at $3,141 million, which reflects growth of 9.4% year over year and 17.2% sequentially.

The Zacks Consensus Estimate for the segment’s operating income stands at $851 million, up 13.2% year over year and 50.9% on a sequential basis.

Asia Pacific

Revenues at the Asia Pacific segment inched up 1% year over year in the first quarter. Notably, the volume of the Coca-Cola brand in China grew more than 20% in the quarter.

Consensus estimates for revenues at the division are pegged at $1,511 million, up 0.3% from second-quarter 2017 and 24.1% from first-quarter 2018.

Moreover, the segment’s operating income estimates stand at $735 million, up 3.1% year over year and 30.1% sequentially.

Bottling Investments

Bottling Investments segment revenues plunged 73% in first-quarter 2018, owing to lower volumes and structural headwinds. Further, the consensus mark for the division’s revenues is expected to be $1,033 million, down 66% year over year and 1.7% sequentially.

Zacks Model

Our proven model does not conclusively show that Coca-Cola is likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Coca-Cola has an Earnings ESP of -0.42% and a Zacks Rank #4 (Sell), making surprise prediction inconclusive.

Stocks Poised to Beat Earnings

Here are some companies that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter:

The Boston Beer Company, Inc. SAM has an Earnings ESP of +13.00% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Monster Beverage Corporation MNST has an Earnings ESP of +3.07% and a Zacks Rank of 3.

Brown-Forman Corporation BF.B has an Earnings ESP of +0.52% and a Zacks Rank #3.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brown-Forman Corporation (BF.B) : Free Stock Analysis Report

The Boston Beer Company, Inc. (SAM) : Free Stock Analysis Report

Coca-Cola Company (The) (KO) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

To read this article on Zacks.com click here.